This month’s learnings and insights section will be covering Government Bonds. It’s been an asset that I’ve been a fan of for a couple of years now given the current level of return one can receive on them. I’ll be splitting these posts into 3 parts. The first section will be a brief introduction as to what Government Bonds are, the second section will be a quick analysis and how I like to think about SA Bonds and the final section will include how I view them as an asset in my current mix of assets.

A reminder that this does not constitute as financial advice and all the views held are my own. This is simply my own views on SA Government Bonds and how I think about them.

- What is a Government Bond?

A government bond is a type of debt-based investment, where you loan money to a government in return for an agreed rate of interest. Governments use them to raise funds that can be spent on new projects or infrastructure. When you buy a government bond, you lend the government an agreed amount of money for an agreed period of time. In return, the government will pay you back a set level of interest at regular periods, known as the coupon.

This is one of the advantages of owning Government Bonds, in that they have stable, predictable cash income. Once the bond expires, you’ll get back your original investment and final interest payment. The day on which you get your original investment back is called the maturity date. Different bonds will come with different maturity dates – you could buy a bond that matures in less than a year, or one that matures in 30 years or more. Just like shares, government bonds can be held as an investment or sold on to other traders on the open market.

The way in which you can access them is through either an ETF or a Unit trust. There are plenty of asset managers in the country that have Bond funds that can help you get this kind of exposure. These products are managed in such a way that there is no “maturity date” and these products can be held for many years. Instead of holding one type of Government Bond (one bond with a fixed maturity date), these funds are constructed in such a way that the investors will hold Government Bonds with different maturity dates and will always have exposure to Government debt.

You might hear investors say that a government bond is a risk-free investment. Since a government can always print more money to meet its debts, the theory goes, you’ll always get your money back when the bond matures. In reality, the picture is more complicated. Some Governments have defaulted on their debts and failed to meet their obligations to investors. In general, Government Bonds are looked as the safest asset due to the fact that the government will make the payments, even if it needs to hike taxes to collect more money to pay off its debts. That’s where the “safety” comes from.

2. What is Yield to Maturity?

The yield to maturity is the rate that your investment will yield over the life time of your Bond. There is an inverse relationship between a bond’s yield to maturity and the price. If the yield goes up, the price will go down and visa-versa. Various economical, internal and external factors e.g. the inflation rate, GDP, the currency etc. will influence the yield to maturity on a daily basis. High interest rates are usually indicative of investors finding something worrying in a country. There may be heightened political issues or tensions, a precarious budget deficit position or some other perceived riskiness in allocating money to the borrowing country.

There also tends to be a good correlation between a higher credit rating and lower interest rates. Countries that are perceived to be safer based off of certain credit metrics will pay lower interest rates on their Government Debt; whilst those that score negatively on these credit metrics tend to pay higher interest rates on their Government debt. Supply and Demand dynamics also have a significant impact on yields. If there is a large demand for Government Debt, then investors are willing to accept a lower return on their investment (i.e. they’ll charge a lower interest rate on the debt). The opposite is true when there is an oversupply of Government debt; the debt needs to be priced attractively enough for people to invest. (You’d loan them more money if you can receive a higher return for the level of risk you’re taking).

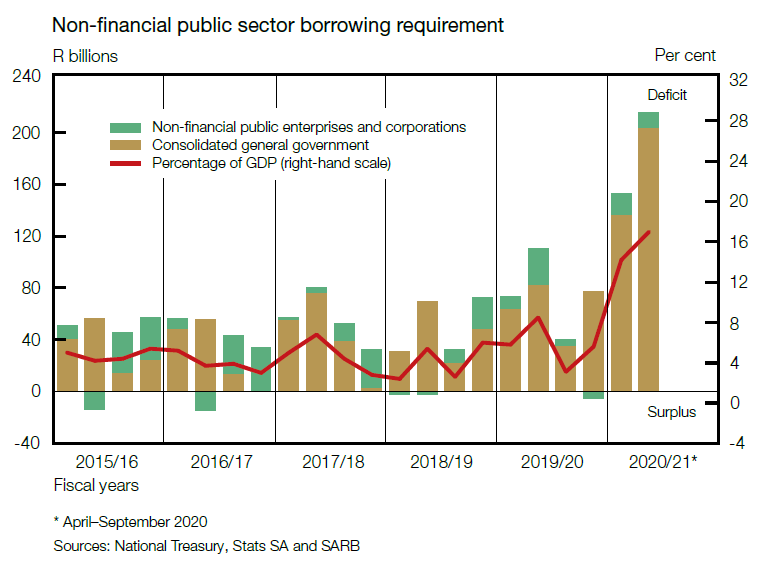

Below is an idea of the borrowing the South African Government + Public Corporations require for the next year. As you can see, the borrowing requirement has increased quite dramatically. The government now needs to borrow close to R200 billion for this year’s expenditures due to Covid lockdowns, fall in revenue collections and increased support required for the economy.

3. Key Risks

Aside from credit risk (the risk that the person/entity you’re lending to cannot pay you back), there are a few other potential pitfalls to watch out for with government bonds: including risk from interest rates, inflation and currencies.

Interest rate risk is the potential that rising interest rates will cause the value of your bond to fall. This risk is magnified by the Modified Duration of the bond. Modified Duration is the Bond’s sensitivity to changes in the interest rate. If the modified duration of a bond is high, then the impact of a change in interest rates is higher (if rates rise, the impact is negative, if rates fall, the duration impact is positive). Inflation risk is the potential that rising inflation will cause the value of your bond to fall. This is because with rising inflation, the real return on your Bond decreases. If the rate of inflation rises over the yield to maturity of your bond, then your investment will lose you money in real terms. Inflation-linked bonds can help mitigate this risk.

In summary, a Government Bond is a debt instrument that the Government uses to fund itself. As an investor, you’re able to invest in this (that is, you’re able to borrow Government money) and receive interest from them (called a coupon). What matters is inflation risk (how inflation ruins your purchasing power) and credit risk when thinking about Bonds as well as interest rate risk itself (how changes in interest rates affect the value of your bond; think about the inverse relationship mentioned earlier).

In part 2, I’ll be diving more into some analysis and how I like to think about SA Government Bonds…

Stay tuned

One thought on “South African Government Bonds: An Introduction”