This blog post will be highlighting how I think about Government Bonds and my approach in thinking about them. The previous post was an introduction into what Government Bonds are, some key information as to how they work and some of the risks associated with investing in them.

When I think about Government Bonds I always link it to how much yield I am getting above inflation. The difference between the nominal yield and inflation is called the real yield. It is the increase in purchasing power you should be getting on your investment. A simple rule that I always use when thinking about where to invest my money is how much return am I getting above inflation, as I am interested in growing my purchasing power over time. I will clarify this concept with a simple example.

Imagine you had R100.00 and you had 2 options, either invest the money or use it now and buy a set of earphones (assuming you can get a pair of earphones for R100.00). Now let’s assume inflation is 5% per annum and a Bank Savings Deposit offers you 4% interest per annum. In a year’s time, you will have R104.00 in your Bank account but now, the earphones cost R105.00. You cannot afford the earphones, which is a shame because a year ago you could afford them. This is an example of a loss of purchasing power. Your investment did not beat inflation and you cannot afford to buy goods and services that you were able to afford a year ago. This is why I always aim for a real yield that is positive and not negative.

Now, coming back to the SA Government Bonds…

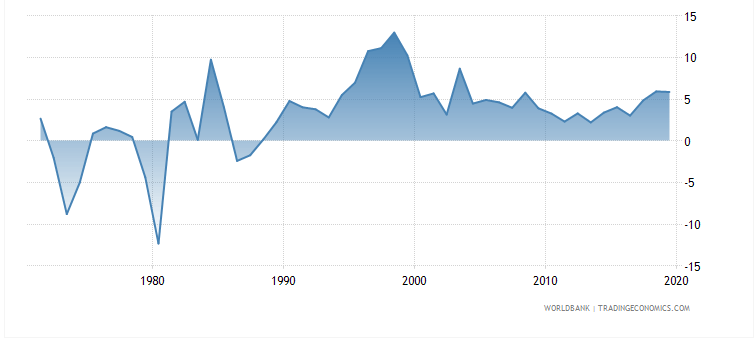

The reason why I still like buying Government Bonds is because the current real yield on SA Government Bonds is really high, relative to its own history. The current SA 10 Year real yield is 6%, and from the chart below, you can see that the yield has not been this high for almost 20 years, at least not for long enough time periods. South Africa’s nominal yields reached levels close to 20% during the late 1990’s as the Asia crisis occurred and sent ripples of fear into Emerging market currencies and Interest rates. So I’m getting a pretty good yield on SA Government debt since the yield hasn’t been this high in a while.

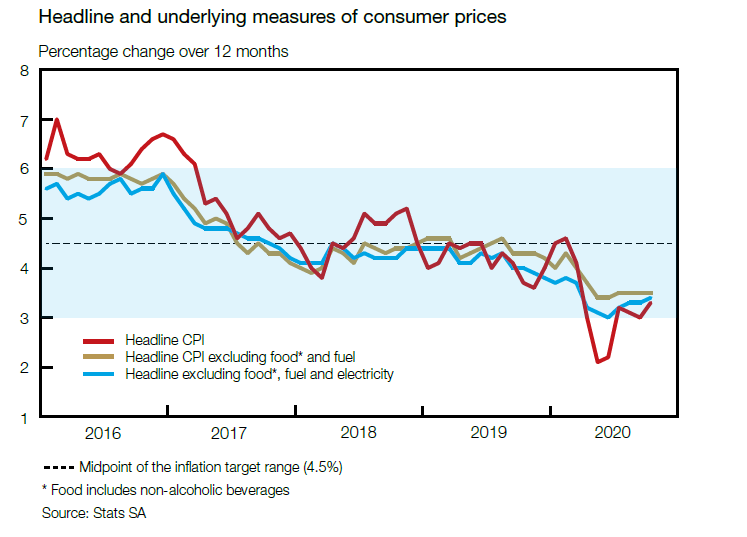

I’m also a big fan of Bonds at the moment because of the inflationary environment. Inflation is coming in pretty low, and without much pressure in the near term. This is positive for bonds because the real yield you get is quite high. With inflation being low, the real yield on SA ALBI Bond Index is close to 6% currently, which is also high relative to history. Below is an image from the SARB’s Quarterly Bulletin (December Edition, 2020) and shows the inflation profile of South Africa over the past few years. In my view, we will stay at this level of inflation for the next couple of months, as the economy slowly gets back onto its feet.

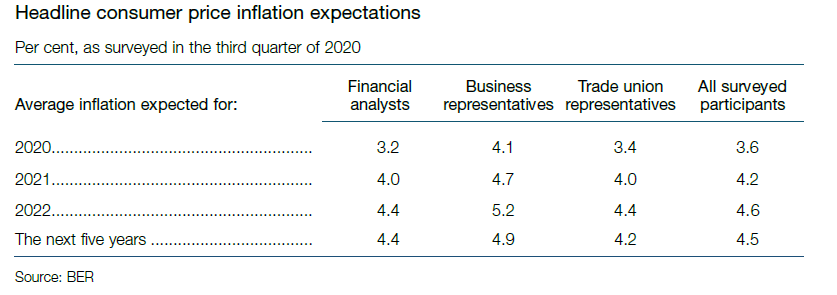

Market participants are also expecting inflation to remain close to 4.5% over the medium term. Below is a table highlighting inflation expectations by different interest groups. Financial analysts are expecting an environment of inflation being lower than 4.5%, as do most groups besides Business representatives; they view it possibly a few basis points higher. Not a materially meaningful difference in my view. These are soft inflation expectations at best in my view.

Now don’t get me wrong, I do acknowledge that Government has a lot of debt on its books and the amount of money that needs to be dedicated to Eskom and the like is huge, but at these levels in interests rates, and given how low the Repo Rate is, this is a great opportunity to pick up high yield without taking on additional corporate risk.

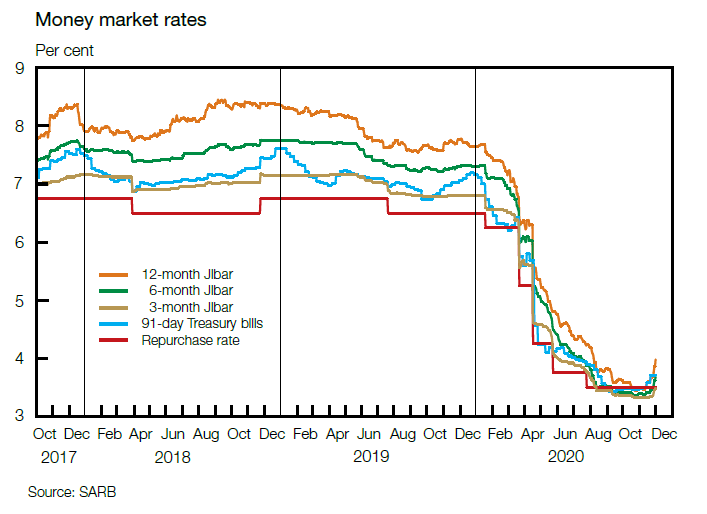

Bank deposits at banks are offering very low rates and the chances of earning inflation beating interest is low, so Bonds win in that regard as well. The graph below shows Money market rates. This is what most Money Market Deposits at Banks offer to clients. The lower the Repurchase Rate (Repo Rate), the lower the interest clients can expected to be generated in their Savings accounts. This rate has gone from 8.5% down to around 4%, almost half of your expected returns has been wiped out.

Low inflation means high real yield and most market participants are expecting an inflation level of close to 4.5%. This should mean that with bonds even staying at 9.3%, we get a 5% real yield expected return, which is quite high.

Also, according to theory, a Government bond is the safest asset in a country given the fact that the Government can technically never run out of money. So you implicitly have the safest asset in South Africa offering the highest real yield it has in almost 20 years and is expected to maintain this level of return as long as inflation remains well behaved, and given the current environment, it is expected to.

To me, the easiest trade in the world.

Really enjoying these posts. Looking forward to the next one 😊

LikeLiked by 1 person