In today’s Financial education segment, we will continue on the topic of South African Government Bonds. We will be discussing a different type of Government Bond that investors can use to protect themselves against the adverse effects of inflation. Today, we will be discussing Inflation Linked Bonds. We will discuss what they are, how do they work and how I think about the asset as part of a portfolio.

Once again, I need to highlight that the information and views expressed in this post are my own and do not constitute as financial advise.

Before we begin, I’d like to have a basic introduction or refresher as to what inflation is. Inflation is the decline in purchasing power in a given currency over time. The rise in the general level of prices, often expressed a a percentage, means that a unit of currency effectively buys less than it did in prior periods. Inflation can be contrasted with deflation, which is the rise in the purchasing power of a currency increases and the cost of goods falls.

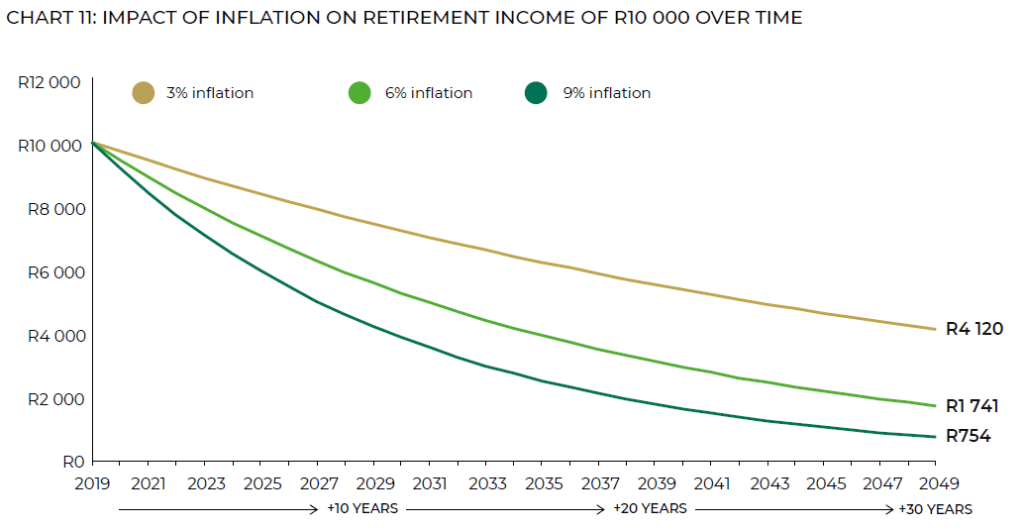

To give you an idea of how inflation works, here’s an example below showing the impact of inflation on your savings if you are earning a negative real return. Recall, the real return on your investment is the return you get after accounting for inflation. It is the change in your purchasing power.

The chart below, sourced from MacroSolutions ‘Long Term Perspectives 2020’ document, demonstrates how your purchasing power declines with higher levels of inflation through time. The gold line shows how the decline in your purchasing power occurs when inflation is 3% per year. As you can see, after 30 years, your initial investment of R10 000.00 will have an equivalent value of R4 120.00, a decline of just shy of 60%. The same effect is much worse when we have inflation at 6% per year (light green line). Over the same period, you will see your initial investment now sitting at an equivalent R1 741, a decline in purchasing power of close to 83%. At 9% inflation (dark green line), you lose close to 93% in purchasing power.

In short, inflation is the invisible enemy that investors always need to be wary of. Returns should also be considered in real terms and not just in nominal terms. The goal should be increase purchasing power and not just focus on nominal returns.

Now, back to Inflation Linked Bonds…

- What is an Inflation Linked Bond?

An inflation-linked bond is a bond issued by the government where the coupon payable and the principal amount payable at maturity of the bond are linked to inflation. On maturity, the capital amount paid out is also linked to inflation. If there was deflation over the term of the bond, the principal amount payable at maturity will be no less than the initial nominal value of the bond.

The bonds offer a guaranteed real return that is known at the outset, if held to maturity. The coupon rate is a fixed percentage of the principal amount, adjusted for inflation, payable twice a year.

2. How it Works?

An index-linked bond is a bond which has its coupon payments adjusted for inflation by linking the payments to some inflation indicator, such as the Consumer Price Index (CPI).

Your investment in these bonds will increase in value every six months in line with inflation (being the general increase in prices as measured by the Consumer Price Index announced by Statistics South Africa). This process is known as index linking. In addition to this inflation adjustment on the amount invested, you will also earn further interest on your investment, payable on specific interest payment dates. The investment will earn interest at a six-monthly fixed real interest rate (this is the difference between the nominal interest rate and CPI rate). This rate is derived from government’s inflation linked bonds yield curve, as traded on the JSE (Johannesburg Stock Exchange) and calculated separately by the National Treasury for the various terms. The combination of index-linking and a fixed interest earned on Inflation Linked Bonds means that your savings are guaranteed to grow ahead of the rate of inflation.

In essence, your capital invested is adjusted for inflation over time, and every 6 months when interest is due, your interest amount is based off the adjusted capital value of your investment, thus increasing your interest payments above inflation, given the fact that your coupon will already account for a change in inflation.

3. How I think about the Asset

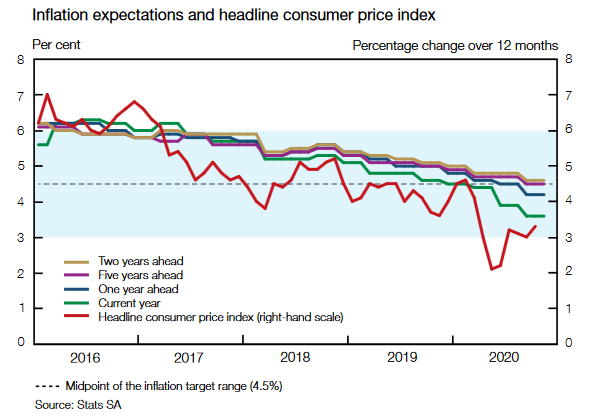

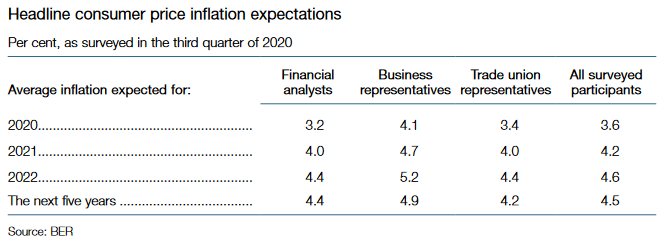

Currently, with inflation expectations below the midpoint of the SARB’s midpoint target, I am not especially worried about inflation. As shown in last week’s post, inflation expectations are muted and a lot of market participants are not expecting any inflation pressures over the next few years.

With that being said, Inflation linked bonds are offering a lot of value at close to 5% real yields on offer. This is quite cheap relative to history (remember, there is an inverse relationship between yield on a fixed income instrument and the price; the higher the yield, the cheaper it is and visa versa). It is a good idea to be picking up inflation protection at current levels but I am still a fan of Nominal bonds vs Inflation Linked Bonds.

After all, no one can predict the future so its always a good thing to buy protection whilst its still cheap to do so…

Until next time 🙂

Thomo

Thank you. I’m enjoying this series-looking forward to the next one✨

LikeLike