Welcome back to another edition of Random Walk Theory. I’d like to take this opportunity to celebrate the fact that this is the 10th post on Random Walk Theory (I hope that you noticed). A small win, but a win I am proud of. Thanks to the readers who’ve been with me on this journey since the first post, and all the engagement I’ve been getting. Some really cool stuff has come from the conversations and hopefully they’ll manifest into further posts.. I’d also like to welcome those who have wandered over here (and thank the force that drew you here), I hope you enjoy the posts and find them useful. Finally, I hope that all of you had a great Easter weekend and got some rest.

In today’s post we will be doing a market review of the 1st quarter. This is the first market review on this blog so best to bed down some structure so that we have a framework for future posts. In order to do the analysis, we need to make sure that we are reading all the returns in one common currency. For the rest of the post, returns will be discussed in USD terms, unless stated otherwise. This allows us to compare different countries using 1 currency as opposed to representing returns in different currencies. We will begin by discussing the performance of different equity markets over March. We take a look at South African equities in some detail and look at which sectors performed well and which sectors lost out. We will then look at performance over the full quarter and have a look at which assets performed the best and who were the losers. Finally, we will have a look at some stuff I found very interesting and I’ll discuss some thoughts around them.

Let’s get stuck in.

Performance over March.

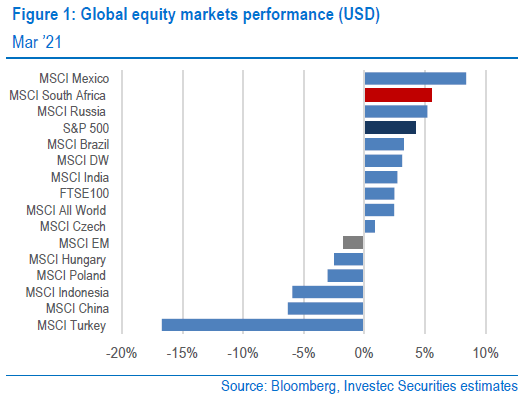

- South African equities have been quite strong over the past month. When looking at South African equities relative to other global Emerging Market peers, we come out as the second best performing stock market over March. Mexico is currently leading the pack after having a strong March.

- South African equities have outpaced several peers including Russia, India, Brazil and has also outperformed the S&P500 in USD terms. That means that if you held SA Equity this past month, you made more money in USD than someone holding US Equity.

- On the other side of the spectrum, you have Turkey and China’s equity markets taking a bit of a dip. Political risks in Turkey have always been detrimental to their currency and during March we saw some Turkish Lira weakening. Chinese stocks have also dropped given recent scrutiny around Tech businesses having such a massive impact on public sentiment and influence. Efforts around more regulation in the sector spooked investors and has driven the Chinese index lower.

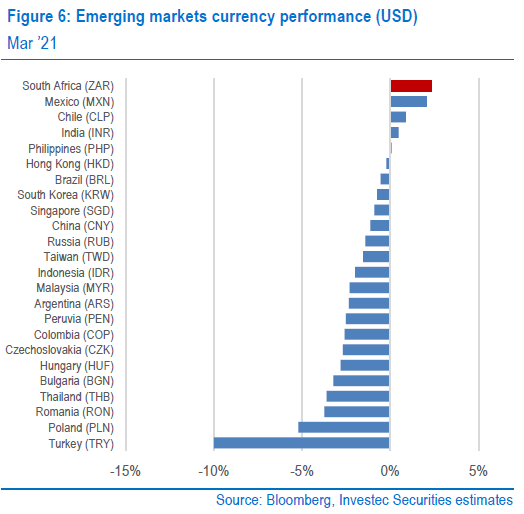

- Looking at currency performance, the ZAR has been the star performer amongst Emerging Market peers. Mexico has also held its own, coming in at 2nd place. The past month saw the Dollar gain some strength so a lot of currencies have lost over value over the month. The ZAR and Mexican Peso were able to keep their heads above water and saw small, but positive returns. Looking at the losers, Turkey stands out with a loss of close to 10%.

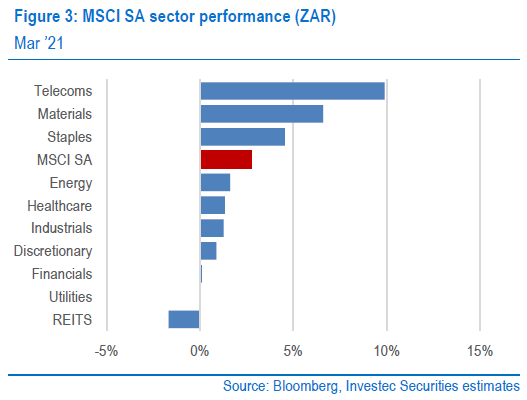

- Looking at sector performance within the South African market, Telecomms, Materials and Consumer Staples outperformed the index itself. Looking at the losers, REITS (Real Estate Investment Trust) continued to disappoint investors, as lockdowns and Working From Home strategies have decreased foot traffic in the malls and left many office parks vacant. Plenty of headwinds are expected but with vaccination programs on the way, we should be coming to the end of such poor performance.

The charts below highlight the comments made above. The first chart highlights the global equity performance over the month of March for a variety of Emerging Markets. In USD terms, South Africa returned just above 5% over the month.

Below is a picture ofFX performance over the month. Along with Mexico, South Africa’s Rand held up well relative to other EM peers.

Looking at Sector Performance below…

Performance over Q1 2020

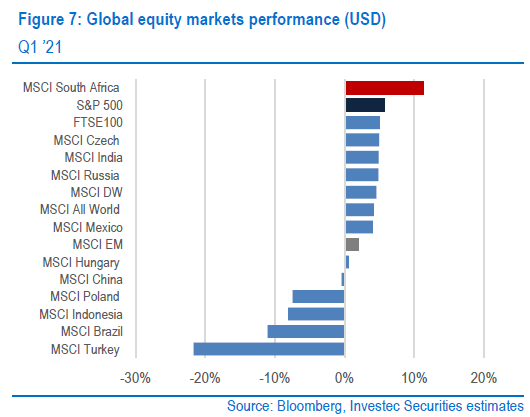

- South African equities have found their sparkle once again. The MSCI SA Index was the star performer when looking at its performance relative to other Global markets.

- To give you a sense of SA’s performance, the MSCI SA Index outperformed the US Large Cap Index (S&P 500), MSCI Taiwan’s tech-heavy index, the UK as well as the MSCI World Index.

- With the mix of Materials, Oil and Tech, South Africa has almost been “The Best of Breed” when looking at the make up of the index. Combined with a relatively stable ZAR, we saw great performance over the first Quarter of the roaring 20’s. The exposure to commodities has also been instrumental in driving our returns as a market.

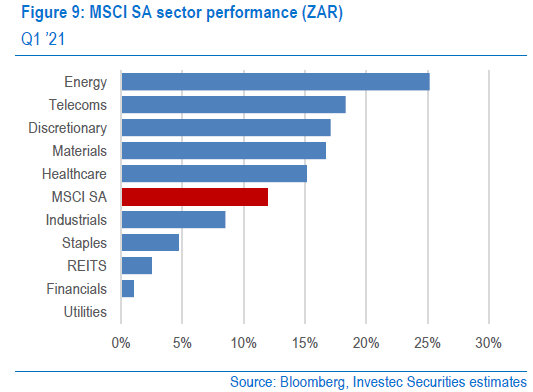

- Looking deeper into the different sectors that make up the MSCI SA Index, we see that the recent performance of Oil, Telecomms, Materials and Discretionary Consumer sectors have been driving the index performance. On an even more positive note, we see that all sectors within the MSCI SA Index basket all had non-negative returns. It seems as though SA’s market saw a broad based lift.

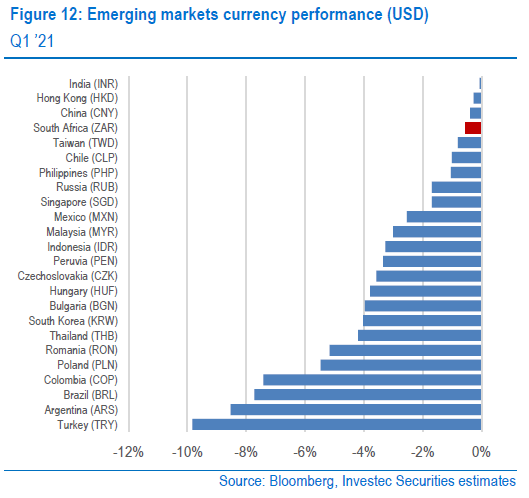

- From a currency perspective, most currencies have lost some value relative to the dollar as a recent rise in interest rates in the US as well as a rise in growth expectations have caused the USD to strengthen. Given this, the ZAR has been able to hold its own and only experienced some slight weakness against the Dollar, but has done very well relative to other Emerging Market currencies.

- Looking at some of the losers, it appears the isolated political issues have been the main reason for Turkey and Brazil’s recent under-performance from both a currency and market perspective.

- Both countries have seen political risk increase as members of important institutions were sacked. One can recall when we experienced the same rise in political risk when our Finance minister was suddenly fired and replaced by someone who no one seemed to really know, which led to a massive spike in our Government Bond yields as well as the currency. Such random political flare ups tend to remind investors that in many Emerging Markets, you tend to see some unorthodox policies that aren’t similar to your own, and there lies the risk.

- What was interesting to me was the lack of response in the ZAR to this. One would think that if there’s a spike in EM risk, the ZAR tends to sell off as well but it seems as though the ZAR has been able to miss out on much of this “contagion risk” from political flare ups in Turkey and Brazil.

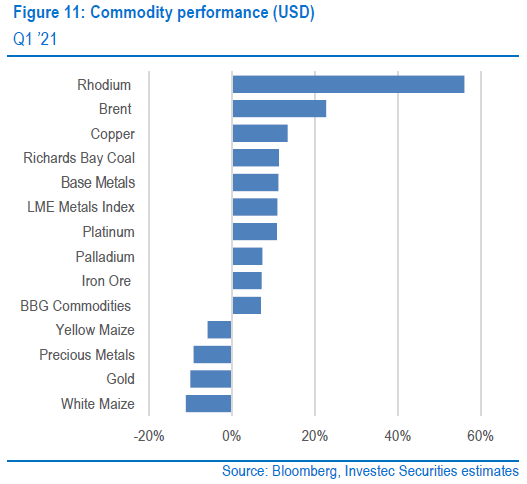

- Finally, looking at the Commodity basket space, South Africa’s export basket of Precious Metals as well as Industrial Metals all saw positive increases in value over the first quarter. This is positive for South Africa given that we are still a commodity-based exporter and commodity prices matter for growth in South Africa.

Below are some charts highlighted what is mentioned in the list above.

First, we look at the Equity index performance, in USD. South Africa’s market has found its way to the top of the table, with its mix of Tech, Materials and Industrial companies that have benefited from a recovery in Global growth.

Below is a look at the returns of the different sectors within the MSCI SA, the returns are stated in Rand terms and not in USD

Having a look at currencies, the ZAR held up pretty well in the face of USD strength as well as increased selling of Emerging Market assets.

And finally, a look at our commodity exports. We see some solid positive movements in our export basket. Rhodium has absolutely shot the lights out, and all other industrial metals have done pretty well. Overall, this is supportive for South Africa’s Trade Balance. Oil has also increased, which tends to be passed through into the economy via higher fuel costs, but for now all other exports are performing well.

Summary/Outlook

Overall, things are looking pretty good for South Africa from a market perspective. If this trend continues, we could see some really great returns for South African assets over the next few months. I still believe that South Africa is a great destination to be invested in. I still believe that there’s a lot more room for SA equities to perform well.

With the world recovering from the global pandemic and most Governments and central banks standing ready to support the economy, South Africa should benefit from a global recovery in trade, and particularly from the sustained strength in Precious Metal and Commodity prices

Looking at Wealth across the US: Millennials are owning a smaller share of the pie.

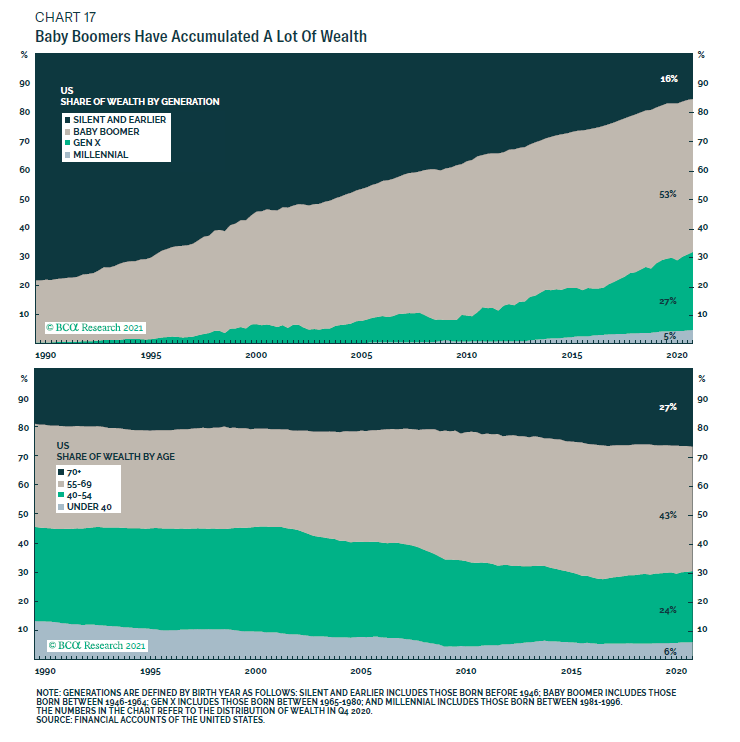

Lastly, I came across some interesting chart that looked at Ownership of Wealth in the US by different generations. I was curious to see how the distribution of wealth has changed in the US over the past few years to get a sense of what the underlying dynamics could be in the country. Were younger people earning a bigger piece of the pie? I was curious to see if all the wealth being shown on social media was as wide spread as it looked. It felt like a lot more Americans were making money, especially the younger generation.

Although it does not seem to be the case, their share of US Wealth has actually decreased. The younger population of the US holds less wealth than their elders did when they were their age. It had me questioning what could the reason be? Could it be ownership of investment assets vs physical assets? If so, where are younger people in the USA keeping their money? Surely they should be aware of the stock market and the potential gains that they could get? Or are they simply not as wealthy as they’re making themselves out to be? Are they saving and investing in really inefficient ways? Could the cost of living just be so high that most of them just break even on a month to month basis, therefore not being able to accumulate wealth on a stable and consistent basis? Don’t know where to go further from here so I’ll just put a pin in it here.

Who knows, maybe we might just find some stuff out later…

Hope you guys enjoyed this post. I’m hoping to get more market commentary work out in a more consistent way, perhaps maybe every week there would be a “bulletin” style newsletter.

Continue to like, comment and share these posts. Encourage your friends and family to subscribe and get all posts sent directly to their mailbox.

Here’s to the 10th Post 🙂

Thomo