Hi everyone 🙂 . Welcome back to another episode of Random Walk Theory. In today’s post we discuss something that is at the top of most people’s mind given the recent interactions I’ve had with a few readers. We discuss Savings and Investments. A topic that gets most people nervous or excited, depending on which end of the spectrum you find yourself (and what your current bank balance looks like.) It’s a topic a lot of people feel nervous about because it is a place of unfamiliarity. Most people haven’t been exposed to an actual budgeting process until they reach their first pay cheque. The only real concept most people have of it is a small module either covered in Primary or High School. Yet, the ability to save and invest is one of the most important things to understand.

I’ll be starting off by sharing a bit of my Savings and Investments journey over the past few years. I’ll then be discussing the difference between Savings and Investments. I’ll spend some time talking through my approach to both Savings and Investments and pass on some useful tips and tricks I’ve used to keep my consistency up.

Let’s dive right in.

Reflecting on my Journey so far…

The idea of Saving and Investing is something most people have a general appreciation and understanding of. People do understand the concept that putting some money away for a rainy day or for a big expense item is a logical thing to do. The problem is figuring out how to do it. This makes the idea much more daunting for people than what is made out to be believed.

A couple of years ago when I started working, I also found myself in this predicament. I started out not having a real plan. I had a “we’ll see as the month goes by, as long as I have paid off the basics” approach to expenditures. I had just started my first job and didn’t have any responsibilities to really look out for. I figured since I had a Pension plan from work, that I am already doing enough in terms of savings. I was also new to Cape Town so I was keen on having fun and experiencing this new city. It was all about the Vibes to be honest. To put it bluntly, this is where I was in terms of my financial astuteness:

- Never had an explicit amount of money that I wanted to save per month.

- No real anchor around my spending on Groceries, Entertainment and Going Out etc. I was pretty much allocating as I saw fit.

- I did most of my record keeping in my head. I used a “Mental Accounting” approach vs having things down on paper or on a spreadsheet somewhere.

Looking back with hindsight, this was very counter-intuitive given that I had just started working in the Asset Management industry. Luckily, my perspectives changed due to the people I had around me and as I started developing a deeper understanding what the industry I worked in was really about. I began to really develop a philosophy around savings and investments and began looking at my relationship with money.

My belief is that being Wealthy is more linked to having the right behaviors with money vs having lots of money, which ends up being an outcome of your behavior with money. Being able to harvest savings from just about any level of income is a mark of a true money manager in my eyes. Knowing where to allocate spending and capital, given whatever constraint, is true money management. In order to be able to do this, you need to understand what actions you’re taking and also have a few rules in place to keep you on the right path.

So lets start with the basics.

The difference between Savings and Investments

Before we embark on a journey towards financial independence, let us first understand the basics of savings and investments. A disciplined investor creates a balance between the two.

Saving is the process of parking cash in extremely safe and easily accessible assets. The primary aim should be capital preservation and the secondary goal getting some returns, if possible. This can include savings accounts and even just keeping money on hand in a regular transactional bank account.

Investing is the process of using money/capital to generate a safe and acceptable return over a time-period. An investment can include real estate, gold coins, stocks, mutual funds and small business to name a few.

Let’s take a look at the main differences between Savings and Investments:

| Savings | Investments |

| Savings are ideally smaller, for short-term goals in the near future like a vacation, emergency etc. The time horizon on this is usually short (less than 3 years). | Investments involve putting money to work to create wealth for achieving long-term goals like child’s education, house etc.. The time horizon is typically longer term (5+ years) |

| Liquidity is high, giving ready access to cash when needed. This means that you can access your money with very little difficulty and a in a quick turn around time. | Liquidity is usually lower than Savings, given that some investments may need to be invested for a few years, or have “lock in” periods. This isn’t the case with regular Unit Trusts or ETF’s. |

| There is typically no risk involved. Most banks offer a guarantee on your capital. | Risk involved is usually higher than a standard savings account. This is because you’re exposing your money to different factors within the economy and there is no underlying guarantee of protection. |

| You can earn interest on your savings. The interest earned on most savings accounts is low and barely beats inflation. This is the price for safe assets. More safety usually comes with less return on offer. | Investments have a potential to yield higher returns, where investments appreciate over time. These are the assets that tend to offer higher return given the fact that more risk is embedded in them. |

My approach to Savings

When I think about my Savings, I like to make it as seamless and boring as possible. When I say boring, I mean that I don’t try get too cute and clever with my method. I leave all the thrills and spills for my Investment Portfolio that I manage (Hopefully we’ll have a dedicated post on my portfolio soon). I prefer to keep it simple and classy.

As a starting point, I believe that everyone should have some sort of Scoreboard for their Income and Expenses as well as their asset and liability base. The first step to saving is actually knowing how much you’re able to save and what your current level of saving is. Knowing how much money you have saved where it is is critical, otherwise you’re flying blind. Having your scoreboard allows you to get a better picture of what needs to be sorted out. If you know the state of your finances, then can you start cutting the fat where it really matters. This can be in the form of a budget, or having some useful Finance apps that consolidate your income and expenses into different groups.

The next step is to decide on a Savings Rate. This is the percentage of your take home pay that you allocate to Savings and Investments. I like to think of it as a rate at which your harvest a part of your own income for yourself. Our salaries are always leaving our pockets one way or another and paying someone or something else, so having some percentage of it coming back to you is important, and I don’t think a lot of people think about it that way. Having a figure that you target as a percentage of your income is useful in that there will always be some level of harvesting at various levels of your income. I believe that its a realistic way of growing your wealth in a manner that is consistent with your income level. Finding the balance is key.

I’ve used a Savings Rate of 30% over the past few years as a straw man to make sure that I have a consistent number I always target when looking at my monthly savings and investments allocation. I found that a higher savings rate was possible, but it wasn’t really any fun for me. I believe in also allocating some money to fun, because Life is meant to be lived and enjoyed. My view is that you need to have a balance of both saving but also allow yourself to have some fun. Tailoring a number that will be meaningful (I found that at minimum, everyone should have a savings rate of 10%) but will also make the behavior sustainable over a long period of time (I tried 40%, but became frustrated when I didn’t have enough money for other fun things) is the best way to keep consistent and honest with yourself.

The 3rd step is setting up an automatic debit order and sending the money straight through to a Savings Account. I use the analogy “Death by 1000 cuts” as a way of making this concept make sense. Everyone hates debit orders coming in a few days after pay day. My view is that if you already have 3 or 4 debit orders coming at the end of the month, you may as well add an additional one, but this time this debit is FOR YOU. ALWAYS PAY YOURSELF FIRST !!! The “pain” of the other debit orders has already happened, so the addition of 1 more doesn’t add a massive amount of “pain” already experienced. If you’ve already taken the pain of the other debit orders, you may as well take an additional knock but this time, the money taken off is actually for you. This is my “Death by 1000 cuts” analogy. What’s one more cut when you’ve already had 900?

My approach to Investments

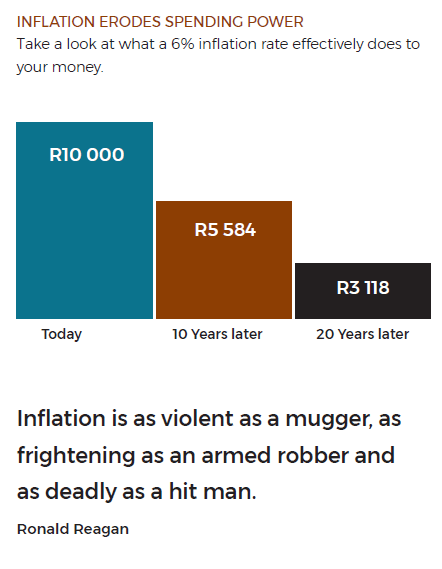

As a starting point, I need to give you my perspective on Investments and how I look at it currently. I consider myself young and I have a long investment time horizon when I think about my actual time to retirement (still have +30 years to go) so my approach is based on this fact. I also look to place my money in assets that can beat inflation. This is important as growing your wealth means being able to increase your purchasing power over time. You need to invest in assets that will not only allow you to buy the same amount of goods and services now, but will also grow your ability to buy even more goods and services in future, despite what inflation may have done to the cost of those goods and services.

The chart below is a reminder of what inflation can do to your wealth.

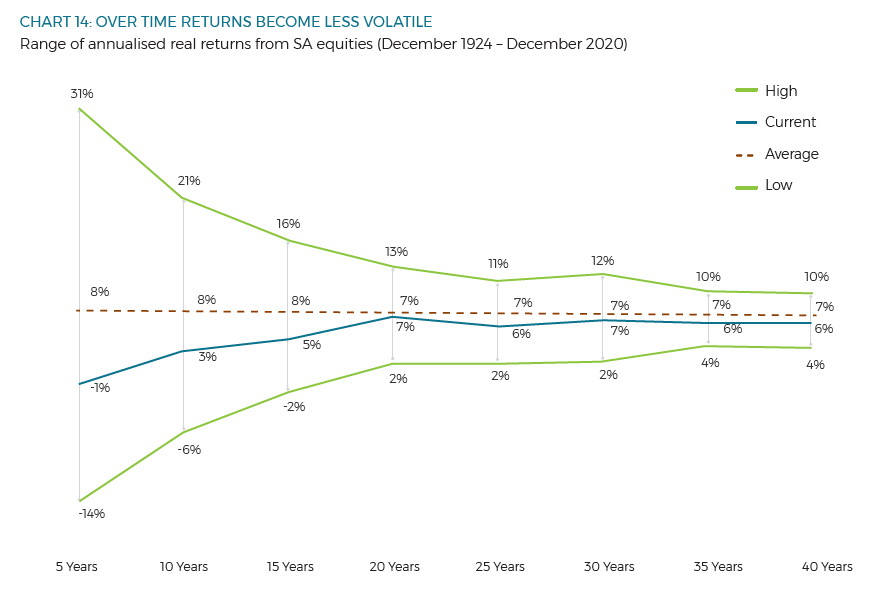

My view is that with Investments, time is your friend. If you have a long time horizon, you are able to ride out short term market moves and allow your investments to grow over time. Short term market movements shouldn’t worry you as you have a lot of time to see the market correct and go on to produce positive returns. Any short term disruptions can be viewed as an opportunity to buy assets that have now become cheaper. I have used market falls as an opportunity to by more of the assets I like and which I think will still go on to make positive returns.

Over the long term, Equity performance tends to return to some baseline average return. This base level of return differs across markets but on average, SA Equity as well as Global Equity tends to revert back to a yearly real return of about 7% a year (in ZAR) for SA Equity and 7% (in USD terms) Global Equity respectively.

The chart below highlights this very nicely for SA Equities. It is important to remember that investing is a long-term endeavor, and the chart essentially demonstrates the benefits of being patient. This time funnel shows the range of the yearly real returns investors would have achieved over various periods (listed on the horizontal axis). The funnel (light green lines on both sides of the “Average line) narrows from both the top and bottom as you increase the length of time invested, showing that time softens the impact of large positive or negative periods. Although losses can be experienced over shorter periods, history shows that long-term investors have been rewarded with positive real returns (these are returns above inflation), but only if they had the patience required to unlock that risk premium (the reward investors receive when taking on risky investments).

I therefore like to take on as much Equity exposure as possible. I prefer to invest in equities that will produce substantial returns over the long run and I like investing in funds that have aggressive mandates. This means that I like funds that are looking to grow my wealth by taking risk and hold positions in high growth companies or sectors. With my long investment horizon, taking risk is to my benefit because I have a lot of time to ride out the risk. This kind of approach also allows me to beat inflation over time as Equities tend to provide a return above inflation.

There are many approaches to investing and I think that it isn’t a “One Size Fits All” exercise. We are all different and have very different views on risk taking and what our time horizons are for our investments. What is important is that you have a plan. Working with a plan that suits your needs and is realistic is important. In my view, this is the key to sustainable investing. It is much easier to stick to an investment plan when it suits your needs and also doesn’t leave you feeling anxious. As with almost anything, patience is key.

Hope you found this useful. If there is anything you’d like me to expand on in another post, or you’d like for me to tackle another topic of interest, feel free to let me know 🙂

Until next time.

Thomo.

One thought on “Savings vs Investments: My Approach to Wealth Creation”