Welcome back to another edition of Random Walk Theory. With the winter slowly kicking in, I hope that all of you have been keeping warm and enjoying the change in season. Once again, I’d like to send out a huge thank you to everyone who’s been sharing this site and interacting with the content. It’s really sharpening me up and pushing me to stay on top of things. If you haven’t already, subscribe to my blog (link: Subscribe) and get all the latest posts sent directly to your mailbox.

In this week’s post I’ll be taking a look at what’s been happening with South Africa’s economy. I’ll start off by describing how I think about the South African economy. I’ll then be taking a look at how various sectors have been performing over the past few months, what has been going on from a trade perspective and what I believe the prospects for South Africa’s economy are going forward.

A reminder that this does not constitute as investment advice, and that the views held here are my own personal views.

Thinking about our Economy

Whenever I think about where I want to invest my money, I try and understand how the underlying economy of that country actually works. I try and get an understanding of how this economy makes money and what are its drivers of growth. My belief is that you need to understand the core drivers of an economy if you are to fully understand how a company is impacted by being based in a certain country with certain constraints vs another, less constrained economy. I always try and get a sense of what really matters and what can be thought of as “noise.” This process gets a little tricky when thinking about South Africa because we all can fall for Home Bias, and I guess it’s polar opposite which I will simply call Foreign Bias. To define the two biases, let’s start with the former.

a Home bias is the tendency for investors to invest the majority of their portfolio in domestic equities, ignoring the benefits of diversifying into foreign equities.

So the polar opposite would be

the tendency for investors to invest majority of their portfolio in foreign equities, ignoring the benefits of diversifying into local equities.

So, considering all of this I always refer to a mental model of what I believe really drives South Africa and what really matters when thinking about investing my money here. I believe that what drives South Africa is commodity prices and Global Growth.

We are very much dependent on Global growth and particularly the Commodity cycle. When global growth is strong and the world is expanding, the demand for raw materials and metals drives a lot of production locally. In turn, this tends to start the flow of money within the economy. Given that the economy was essentially built on Mining and commodities, my belief is that all sectors are therefore leveraged to the Commodity cycle. Naturally, if your Industrialization happened during the boom of a commodity, then naturally everything around it gets built to benefit off of that. This sort of rationale makes sense to me, hence why I’m happy to hold it as fact. If no one wants industrial or precious metals, South Africa’s growth prospects tend to be quite dim. We are generally quite well diversified, but we still do rely quite a lot on the resource cycle to get economic growth to the broader economy going.

The cost of capital is also quite important in my view. The higher the cost of capital, the more difficult it is for companies to borrow large amounts of money for large scale projects given the borrowing costs involved. Described differently, it’s much easier to service the debt on a loan of R100 million when your interest cost is 5% vs 10% per annum. Added further to this, we tend to run a negative Current Account balance so we largely depend on offshore capital to fund this additional expenditure. When you need to attract foreign capital, you need to offer investors an attractive rate of return for them to fund your additional expenditure (this is the expenditure you have that is above your income, which is what the Current account essentially is when it is in deficit; a surplus works the other way around.)

So what’s been going on with South Africa’s Economy?

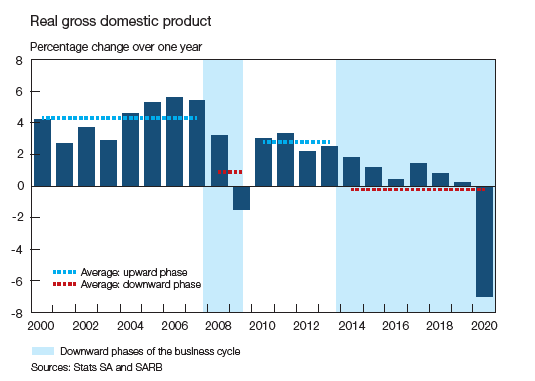

We begin by looking at what has happened over the past couple of months. With the closure of most economies around the world and the halt to most business activity locally, the economy took some massive knocks, with growth rates in certain sectors falling double digits. Looking at the economy as a whole, 2020 saw a big drop in GDP of 7%. The national lockdown-induced contraction in 2020 was the second-largest annual contraction since 1920, when real GDP fell by 11.9%, and was also about five times larger than the contraction of 1.5% that followed the global financial crisis in 2009. The decline in real GDP in 2020 consisted of a substantial contraction of 17.0% in the first half of the year and a recovery of 8.6% in the second half. The chart below shows how large this drop in GDP was relative to the previous year.

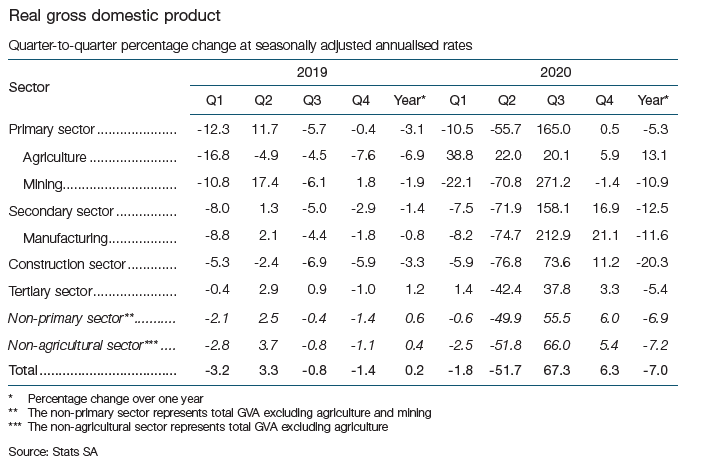

The table below shows the extent to which different sectors were hit. Looking at 2019 Year on Year performance, we see that most sectors were in decline already, with the exception of the tertiary sector, which held on at 1.2% growth. The last column which shows 2020’s year on year performance, we see that Construction, Manufacturing and Mining saw the biggest declines in growth, each seeing declines larger than 10%.

Trade: Looking at Exports and Imports

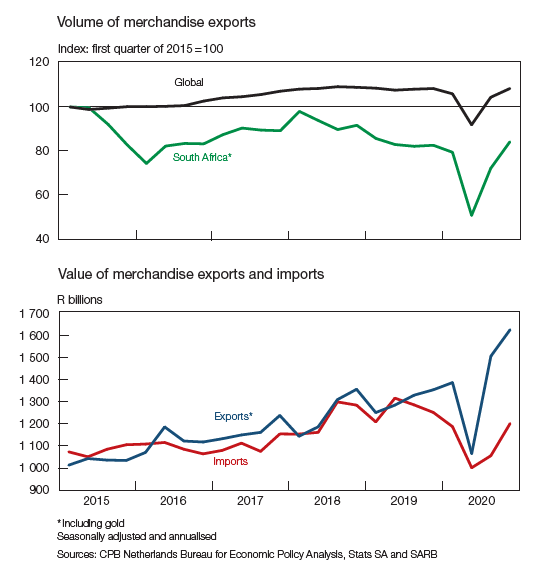

South Africa’s exports followed the further increase in global trade volumes in the fourth quarter of 2020, as trade continued to recover from the COVID-19-induced low in the second quarter. The value of South Africa’s net gold and merchandise exports surged further to an all-time high, while that of merchandise imports rose at a faster pace than in the previous quarter. The chart below describes this. In the first chart (top graph) we have the change in Export volumes of the world and South Africa. It is clear to see that although South Africa has lagged in terms of volume of exports, the recovery pattern is similar to the world’s expansion.

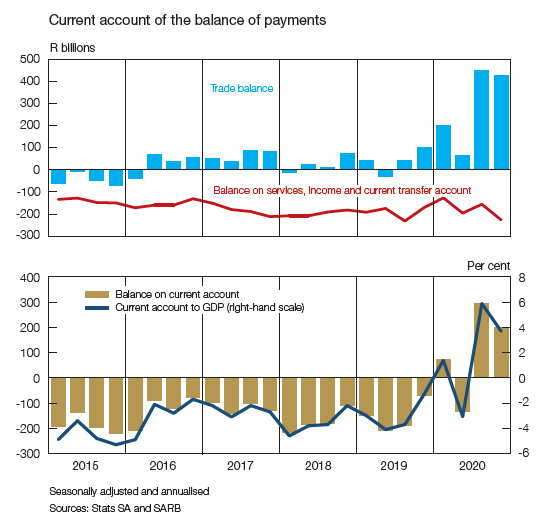

South Africa’s trade surplus narrowed to R425 billion in the fourth quarter of 2020, from the record-high R451 billion in the third quarter. The higher value of imports primarily reflected a sharp increase in volumes, while the increase in the value of exports emanated from both volumes and prices. The smaller trade surplus, alongside a sizeable widening of the shortfall on the services, income and current transfer account, narrowed the surplus on the current account of the balance of payments from R294 billion in the third quarter of 2020 to R198 billion in the fourth quarter, or from 5.9% to 3.7% of GDP.

On an annual basis, South Africa’s balance on the current account of the balance of payments switched from a deficit in 2019 to a surplus in 2020 in the midst of the COVID-19 pandemic – the first annual surplus since 2002. This outcome can largely be attributed to a significant increase in the trade surplus due to an improved export performance, which was supported by higher prices. At the same time, weak domestic demand alongside a sharp decline in crude oil prices weighed down the value of merchandise imports, while the shortfall on the services, income and current transfer account also narrowed. Consequently, the current account of the balance of payments switched to a surplus of 2.2% of GDP in 2020, from a deficit of 3.0% in 2019. The chart below shows how the Trade Balance has been a positive contributor to our Current Account balance.

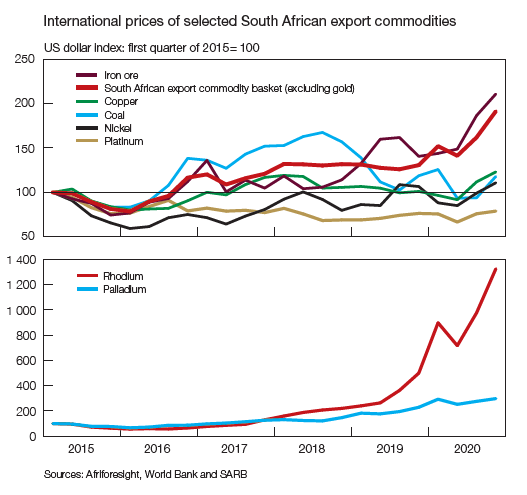

Put in a different way, South Africa has benefitted massively from the recent run in Commodity prices, with precious metals, coal and iron ore performing well whilst our biggest import, oil, has seen a much more mild recovery. This means that we are generating more money from our exports whilst paying less for the imports we buying, leaving us in a net positive position, hence the positive Current Account balance. Over the past 5 years, our export basket has seen massive increases in value. The chart below, indexed to 100 in early 2015, shows the growth in precious metals over the past 4 years. Commodities like Rhodium have gone absolutely bonkers over the past few years as demand for metals that assist in cutting carbon emissions in vehicles gathers pace.

Coming back to my earlier beliefs on how South Africa works, this is a positive development in the way I view South Africa. An environment where precious metals and industrial metals are in high demand whilst oil is cheap spells positive growth in my mind. The environment is supportive for South Africa in that we can make money off our exports and get the economy going again given that most sectors thrive when money is being made from the Mining sector. A prolonged period of strong commodity prices should benefit South Africa from a growth perspective.

Cost of Capital: Interest Rates are low; no expected hikes

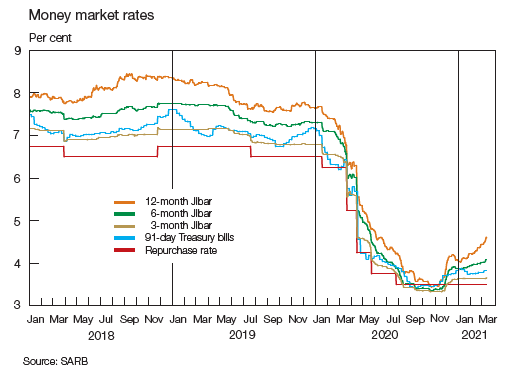

South African interest rates have been falling for much of the past year, seeing the current repo rate near historic lows. The repurchase (repo) rate was kept unchanged at a historically low 3.50% in January and March 2021. The SARB’s Monetary Policy Committee (MPC) cited a number of key challenges facing the domestic economy, including the continued negative impact of COVID-19, while the overall risks to the inflation and domestic growth outlook were viewed to be balanced.

Below is a snapshot of where interest rates are. Over the past few years, we’ve seen interest rates go from 8% to 4%. This means that the current interest rate that you are earning on a simple money market account with your local bank is half of what it used to be 3 years ago. Investors who would typically be happy earning 8% now have to move money into more riskier assets to earn a higher yield. There are other options that aren’t high risk, and are currently offering a good yield. (see my other notes on SA Government Bonds: South African Government Bonds: An Introduction, South African Government Bonds: How I think about the asset., South African Government Bonds: Inflation Linked Bonds)

On the other side of the coin however, this is positive for those looking to borrow to increase capacity or fund their business in case there is a need for expansion or a profitable opportunity comes knocking. At lower interest rates, the cost of capital is lower and therefore businesses are able to fund their projects at better rates. This is positive for a country that has historically had relatively high interest costs on debt over the past few years.

Is this the Perfect Storm?

With strong external demand, low interest rates and a global economy that is slowly on the recovery, I do not see why this is not South Africa’s opportunity to take advantage of the upswing in global growth. With a supportive commodity cycle, South Africa can get the economic recovery on the way and get some much needed internal demand going. Again, the way in which I believe the South African economy works leads me to see that this is could be a positive cycle for South Africa. It provides us an opportunity generate some revenue and hopefully use it to rebuild infrastructure and increase the capital stock required in South Africa to grow. It appears to me that the current environment is the best suited environment for South Africa to grow meaningfully, relative to the past few years where we have seen benign growth.

Hopefully this could be the start of good run for South Africa.

Now, to find some winners…

Until next time 🙂

Thomo.

One thought on “South Africa: Showing Signs of a Recovery”