A reminder that this does not constitute as investment advice, and that the views held here are my own personal views.

Welcome back to another episode of Random Walk Theory. We are 6 months into the year and I hope that you are all thriving. A special thank you to all those who continue to spread the word on this blog. The support is highly appreciated. If you are new to the blog, welcome :), I hope that you enjoy the content and work put in.

In today’s post, I will be discussing my approach to Investments. This is different from savings (highlighted in one of my previous posts, Savings vs Investments: My Approach to Wealth Creation). I discuss how I think about Investments over the long term, what I am currently looking at and some ideas I am working on.

Perspective on Time Horizons

One of the most important factors to consider is your investment horizon. The amount of time you plan on investing will have an impact on the kind of risk you can and should be taking. The longer your time horizon, the more risk you’re able to take given that the money is not required for the short term. You can simply ignore any short term negative movements in the market as you are focused on the long term. In fact, in some instances those short term drops in prices present a good buying opportunity if what you’re buying is a good quality business/investment.

If we think about it using a simple example, consider a scenario where you need to pay R1000.00 for a good or service 3 months from now. This is a payment that needs to be made and is fixed. You can either put the money into an Equity fund (a mutual fund or ETF) or place it in a 3 Month Fixed Deposit and earn interest. Considering the fact that equity markets can be volatile over a short period of time (markets can move sharply over short periods of time due to market reactions to news flow, expectations being missed, FX flow, Trade News, Geopolitical Issues,… just a whole lot of random stuff), you could end up with less than R1000.00 over the 3 month period, leaving you in a worse off position. This is different to the other potential outcome of simply collecting the money from the 3 month fixed deposit and receiving the additional bit of interest that accrued over the 3 months. One investment is safer than the other, especially considering the fact that the time horizon is short.

Now consider the same example, but the obligation is now only due in 5 years. With more time on our side, the dip in the equity markets provides us with a cheaper price point, and given that the date for meeting our obligation is still far away, we are not exposed to the risk of failing to meet our obligation because it is much further out. The cost of taking the risk is lower. We are taking on risk, but the impact of the risk on our ability to meet our obligation is low.

My belief is that with time, you are able to take more risk and give the asset time to grow. The further out your obligation or goal is, the more risk you’re able to take because the impact of short term failures and drops now does not have a material impact on the ability to meet the obligation.

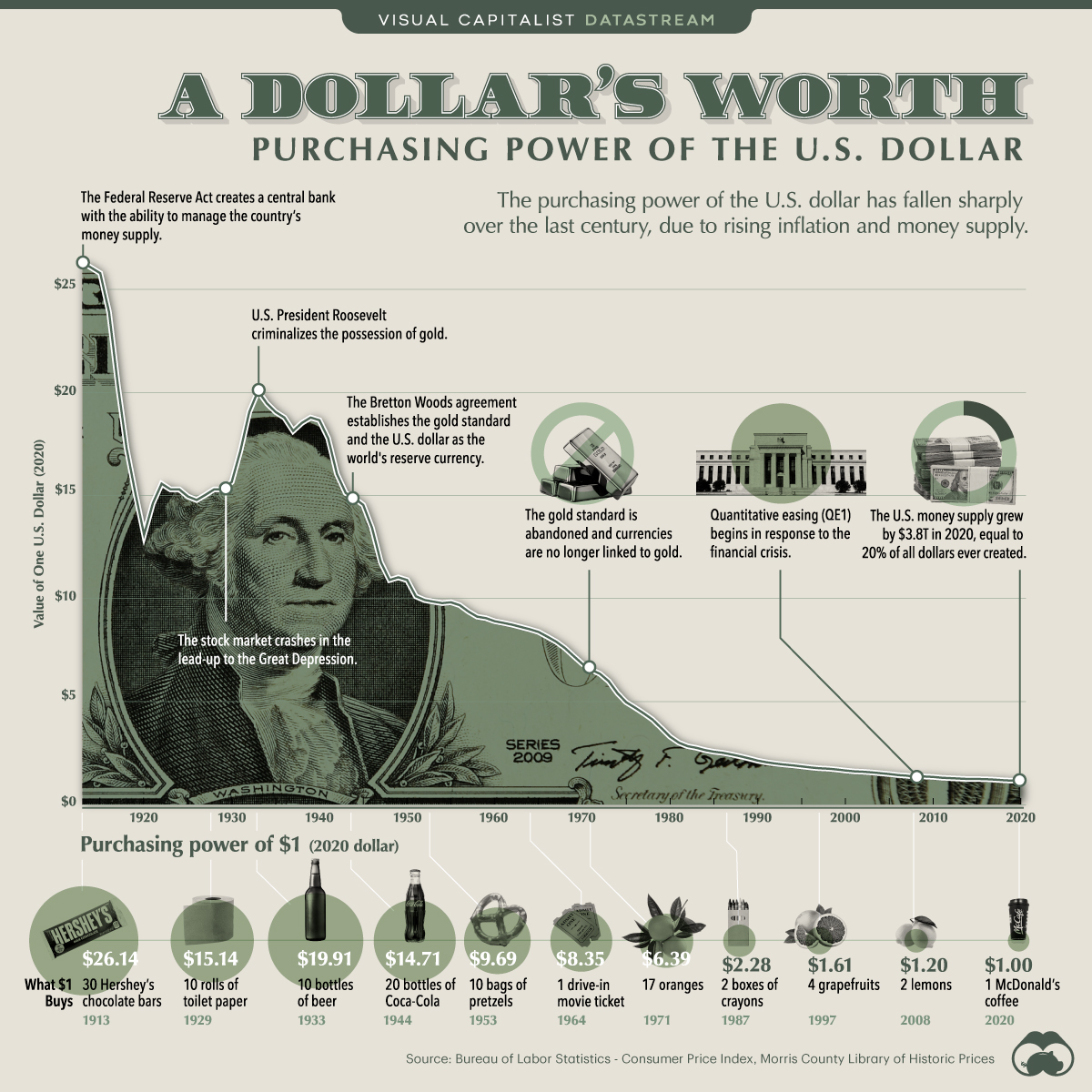

Building Purchasing Power

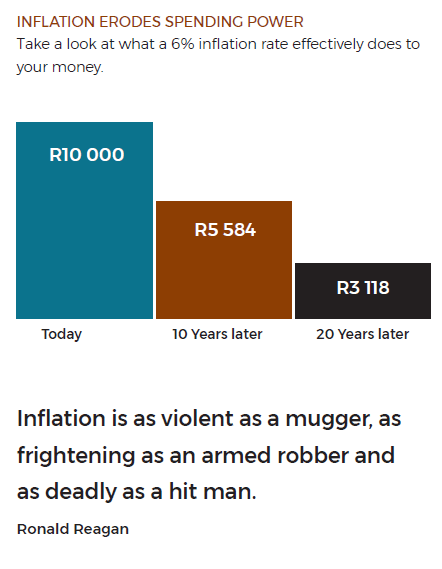

I also look to place my money in assets that can beat inflation. This is important as growing your wealth means being able to increase your purchasing power over time. You need to invest in assets that will not only allow you to buy the same amount of goods and services now, but will also grow your ability to buy even more goods and services in future, despite what inflation may have done to the cost of those goods and services.

The chart below is a reminder of what inflation can do to your wealth.

Now, inflation over time tends to be well behaved and only spirals out of control in certain instances when looking at history. One can never predict when inflation will spiral out of control, one can only ever be prepared to try and beat it or protect against it if it does. This is done by being exposed to assets that tend to move with inflation or protect you against any adverse effects of inflation. I like equities in this regard. Equities have tended to provide decent returns over and above inflation when looking at history. Sure, there are periods where inflation spirals out of control that not even equities can cover the difference, but this occurs during extreme events such as economic depressions or wars. Over time, equities have provided returns above inflation, and considering long time horizons, tend to provide a stable return above inflation.

So… What does this mean for my Asset Allocation?

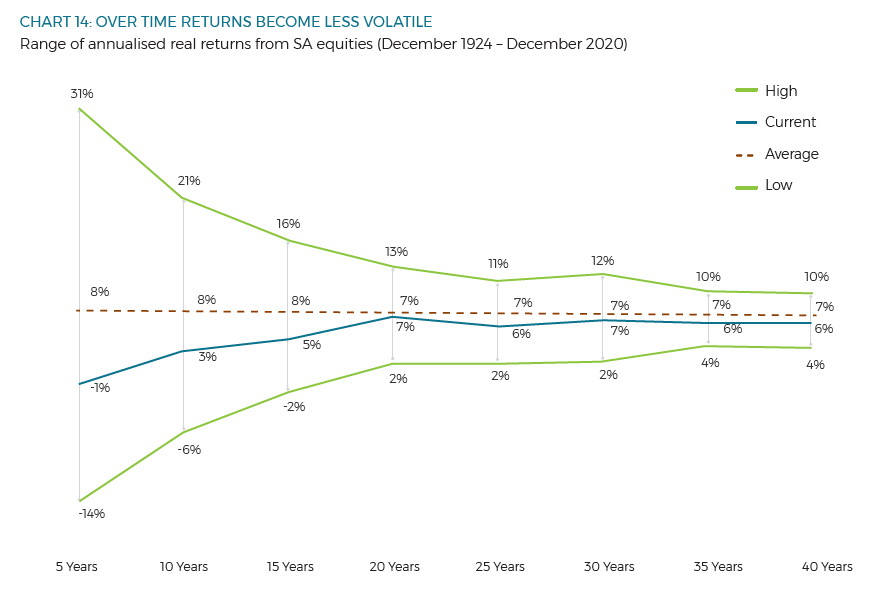

The base level of return differs across markets but on average, SA Equity as well as Global Equity tends to revert back to a yearly real return of about 7% a year for SA Equity and 7% (in USD terms) for Global Equity.

The chart below highlights this quite nicely for SA Equities. It is important to remember that investing is a long-term endeavor, and the chart essentially demonstrates the benefits of being patient and having a long time horizon.

This time funnel shows the range of the yearly real returns investors would have achieved over various periods (listed on the horizontal axis). The funnel (light green lines on both sides of the “Average” line) narrows from both the top and bottom as you increase the length of time invested, showing that time softens the impact of large positive or negative periods. Although losses can be experienced over shorter periods, history shows that long-term investors have been rewarded with positive real returns (these are returns above inflation), but only if they had the patience required to unlock that risk premium (the reward investors receive when taking on risky investments).

I prefer to invest in equities that will produce substantial returns over the long run and I like investing in funds that have aggressive mandates. This means that I like funds that are looking to grow my wealth by taking risk and hold positions in high growth companies or sectors. With my long investment horizon, taking risk is to my benefit because I have a lot of time to ride out the risk. This kind of approach also allows me to beat inflation over time as Equities tend to provide a return above inflation.

Thinking about it differently, most businesses tend to improve with time, especially smaller, more riskier businesses. As time passes, these companies grow their profits, become more efficient and grow in value. By investing early, you get to enjoy the growth phases of these businesses and see your wealth grow exponentially, versus being invested in an already mature, post growth business. You get to reap the rewards of taking on the higher risk.

Where am I hunting?

Given the fact that I like companies that still have some run way to go before they’re considered to be large companies, I am currently finding myself being drawn to the Small cap space. Companies that are considered to be smaller and more riskier than their larger counterparts should do well in an environment where growth is improving, the cost of capital is falling and the driving growth engine is working for that particular country. In my previous post, I highlighted why I believe South Africa finds itself in a particularly good sweet spot with growth surprising to the upside, commodity prices booming and the interest rate has been dropped quite substantially over the past few months. (Link: South Africa: Showing Signs of a Recovery)

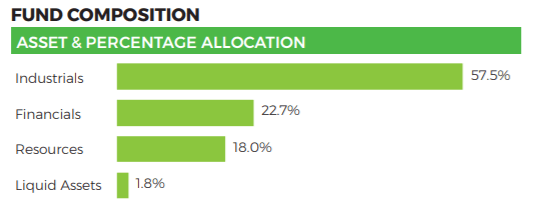

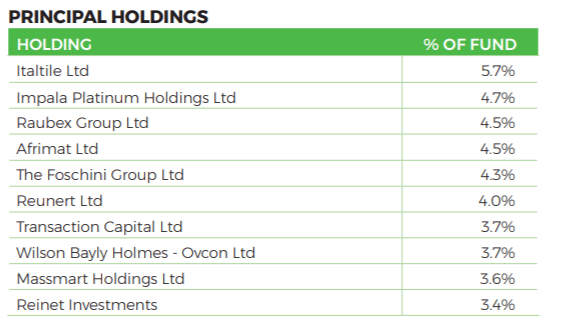

A fund I like in particular is the Old Mutual Small Companies Fund. The fund aims to offer superior returns over the medium to longer term by investing in companies with a market value smaller than the company with the lowest market value listed on the FTSE/JSE Large Cap Index (J205). The strategy suits the way in which I like to think about my investments and aligns with my time horizon in that the fund aims to deliver superior returns over the longer term (more than 5 years). The fund also has a pretty good track record over time, and takes on positions that are meaningful in size, which is another aspect I like. I prefer to hold punchy positions in a portfolio as opposed to holding hundreds of different positions. You make money by taking good sized positions in companies that deliver good returns. Diversification is meant to preserve wealth in my view. Different strategies for different outcomes.

Looking at the make up of the fund, the fund is focused in areas that should currently benefit from the improvement in South Africa’s growth, particularly any growth that comes from a renewed infrastructure drive which the country has mentioned it plans on doing to get our potential growth rate up. A mix of businesses that I think should do well as South Africa recovers from its economic slump. Good punchy positions as well.

I do believe that as younger people who are in the capital formation stage of their lives, we should be taking on more risk in our investment portfolios, particularly when you consider the amount of time we have until we actually retire. Having an allocation to Small Cap equities is a great way to gain exposure to growing companies that are sensitive to the economic cycle and tend to reward investors over long periods of time. It aligns perfectly with long term investing decisions and is a great way of having exposure to high risk, high returns, whilst not being exposed to material impact on your long term goals (short term underperformance of small cap stocks has a small impact on your long term obligation/goal, as there is still a long time until you get there).

I hope you found this note useful. As always, feel free to share this and subscribe to the blog. Every new post will be sent directly to your mailbox.

Happy Youth Day.