Welcome back to another installment of Random Walk Theory. With winter now in full effect, I hope that all of you reading this are keeping warm and staying safe. It’s been a couple of weeks since my last post. I have been working on some new material but as with all good things, it does take time to eventually get to some sort of draft that you can be happy with. Despite the delay, we are indeed back. Hopefully we can pick up right where we left off.

In this article I’ll be talking about something I like to call, The High Price of Missing Out. This is a concept that I’ve been mulling over for the past few weeks but haven’t had the best way of conveying the idea. It’s a pretty powerful idea, in that it can help those who are currently feeling a bit on edge given how the market’s tend to react when the future becomes even more uncertain and opaque than usual. I’ve also had to evaluate my own portfolio given the recent moves in the market, and decided to spend some time thinking about how the current environment is affecting my decision making and what errors could I be making. After all, none of us can predict the future and we are a product of our environment and emotions. Losing money tends to be an emotional thing, and I am sure a few people have started getting itchy feet.

For the sake of perspective, longevity of this article, and to actually have a written down record of what was happening at the time, let’s take a quick look at what’s been going on:

- South Africa has experienced a spike in looting and destruction of private property (mostly commercial real estate and some warehousing centres in Durban), which coincides with former President Zuma (79) handing himself over to serve a 15 month sentence, after he was handed the jail term after he failed to attend a corruption inquiry.

- Different variants of the Covid virus have been found to be more infectious than previous variants, renewing fears of lockdowns happening again across the globe, which would derail the global growth recovery currently underway.

- Government regulation on Tech companies has become an ever increasing theme, with more companies coming under scrutiny by various Governments around the world.

- The Tokyo Olympics are currently underway, with stringent rules and regulations that I’m sure would render even the most enthusiastic fan to question their desire to be in Tokyo right in the first place (unless, you’re obligated of course)

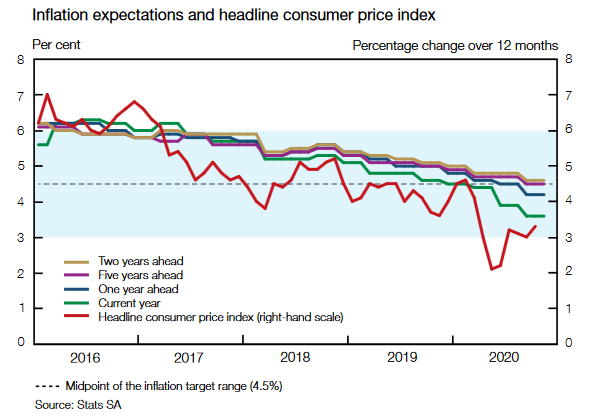

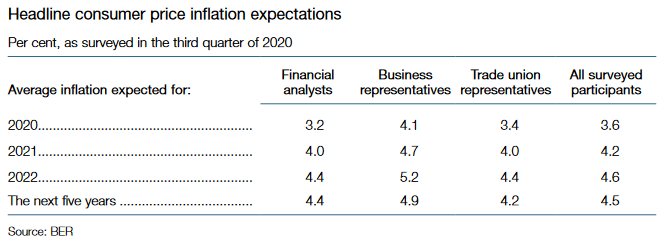

- Expectations of increasing inflation in the future has convinced some market players that the current economic recovery period is almost done, vs another group who believe that the economy still has a lot of room to improve. I believe that this is always happening (people love arguing) but it does seem to be more front and center now than usual.

Casting our minds back by 10 years, one would imagine that if you had received this list from the future, along with some of the other events of the not so distant past (Twitter hack, impeachment of Donald Trump), you’d be laughing at the absolute absurdity of it all. But, what life shows us is that the “unusual” tends to happen more often than not.

So, I guess the key question is, how do you navigate a world in which uncertainty is pretty much the only certainty? In today’s post I will discuss how I think about the markets in periods of volatility. I’ll be touching on some beliefs about markets & people and how they impact our decision making. I’ll then talk through a framework I use as a sense check, and relate it to one of nature’s best predators out there. I use this framework as a way to guard against my own biases and stay the course on my investment goals, especially when things get tense and I want to run for the hills and find safety. By remembering The High Price of Missing Out, I tend to get a better outcome, or at least a better sense of calm in knowing that I have gone through a process that works and is backed by some sound reasoning (at least I’d like to think so).

Some Realities to Deal With

Short term volatility tends to spook most, if not all investors at some point or another. The thought of seeing a massive negative loss over one day can send shivers down anyone’s spine and leave them with a sense of utter shock and despair. The fear of major losses is a pretty big deal, and when it comes to your own investments the topic becomes quite personal.

Now, one can imagine when you’re in an environment where things seem like they’re going to topple over and all is doom & gloom, the first thing you’ll be looking to do is find protection or take some (if not all) risk off the table. Investors face this battle everyday, with a constant barrage of “SELL”, “DANGER”, “FEAR” messages coming from both news networks as well as market feeds. The emotional rollercoaster of it all can leave most with a sense of anxiety and more often than not, lead to actions that may not be the best decisions.

When one is in a state of anxiety or stress, most decisions are taken in order to relieve the stress or anxiety that one is experiencing. That does not necessarily mean that that is the right decision when investing in the markets, or at least not a good decision until you have gone through a process to determine whether the action is beneficial to the Investment Outcome. Put differently, taking action against a risk that has not been fully weighed, considered within the context of the whole portfolio is a poor/less optimal outcome.

I believe that markets should be volatile to some extent, given the very nature and the make up of it. It is a universe of assets, with people who have varying ideas of what the value of these assets are. Because of these differences, one would imagine that people only buy or sell securities at prices that they think are worth, and because we all have varying ideas of what is or isn’t valuable, the accepted price range on a particular asset varies. When the variance in the price of the asset become wider, i.e. the opinion on the value of the asset tends to vary wider than usual, that is when we see melt up as investors all begin clustering around one notion of the price of an asset. I believe that these are the periods where fear or greed tends to grip investors and when we are in this state, less optimal decisions tend to be made. Especially when it its our money.

Coming to this realization, I needed to find a way to filter my thinking around my portfolio when things go pear shaped and guard my decision making process against making poor decisions when fear is driving my thinking, and where better to find a better teacher, but in Nature.

Return vs Risk – Thinking Like a Crocodile

Full disclosure, this section is going to need you to get a little creative in your thinking. If I can pitch this correctly, the message should be as clear as day 🙂

The crocodile has got to be one of the world’s most interesting animals to observe. A perfect killing machine that has roamed the Earth supposedly since the age of the dinosaur. It is one of the most ruthless hunters out there and has mastered the art of stealth and attack.

Now, I need to take the time to set the scene here….

Imagine a river where we have many animals around its banks. These animals are either trying to cross the river, drink water or just cool off in the river. This is the environment in which the crocodile operates in. When things are normal and the banks are pretty empty, there’s not a lot of action going on. A lot of the time, the crocodile is not finding any massive opportunities to benefit from, and more often than not, it needs to work much harder to find a larger meal. I think of this in a similar way as when markets are “normal”… When things are normal, markets tend to be pretty average in their returns and you have to look pretty hard to find something that would produce outsized returns.

Going back to our analogy, lets take things a step further. Imagine that things begin to change in the crocodile’s environment. Something material that would be quite different relative to an ordinary day. Perhaps a Wildebeest migration (that would be different I reckon). In a situation like this, one would imagine that any other animal would adapt to the situation by running away, or steering clear of the incoming wave of Wildebeest, but where others may see danger, that’s when the crocodile springs into action…

If we look at how the Crocodile hunts, we see some interesting things:

- When hunting, the crocodile understands that patience is the name of the game. The success rate of the hunt drops, if it does not wait for the opportune moment; when all the factors align.

- Lesson: Looking for winners and realizing great returns takes time and also requires the right environment for the asset to perform. If one can identify the right conditions in which an asset will perform well, then success should be the outcome, all else equal.

- It’s opportunity lies in the impatience/greed/fear of the animal it is hunting.

- Lesson: Market jitters or excitement provide good entry/exit points. If you are able to identify when markets are fearful or greedy, you are able to buy/sell assets at levels that would be considered abnormally cheap/expensive.

- A crocodile aims to position itself in such a way that if there were to be any discourse or abrupt change, it would be to its benefit.

- Lesson: Gaining a position where the biggest potential for a melt up could happen is advantageous. If volatility is expected, sit where the spillover effects are likely to take place.

- A crocodile knows that even if there is some discourse (clamoring, pushing and shoving), it knows that this may not lead to an absolute jackpot every time.

- Lesson: Not every hunt is successful. We may see signs of opportunity but it is also highly possible that these signals may not produce highly profitable results.

- The most critical element in my mind is:

THE CROCODILE KNOWS THAT IF IT IS NOT THERE, IT WILL LOSE FOR SURE.

Lesson: The High Price of Missing Out

In the analogy above, the key message and the core idea around The High Price of Missing Out.

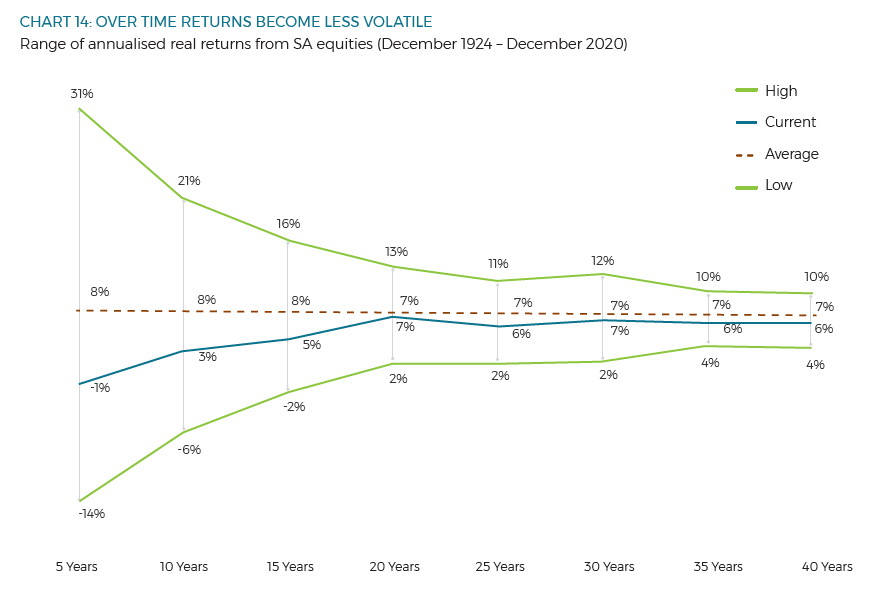

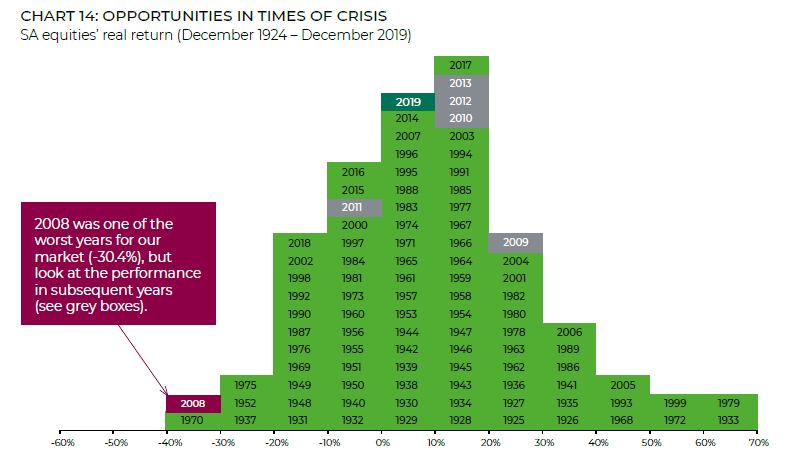

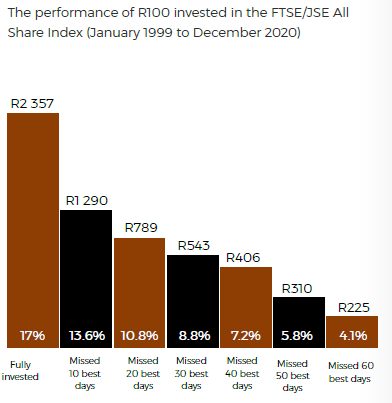

Short-term volatility can often lead to investors selling their investments at the worst time. What data suggests is that trying to actually pull your money out of the market when markets crash actually ends up being detrimental to your overall returns since drawdowns tend to be followed by recoveries. Timing of markets is also very difficult to do and get right often, so building a trading strategy to try and identify the best days to be invested and best days to have no money in the market is nearly impossible. Not only because predicting the future is impossible, but predicting the future consistently is a task only the gods can be brave enough to pursue. So actively trying to manage money in such a way is most likely a bad outcome as you will have days where you are wrong and have the potential to do way more harm than good.

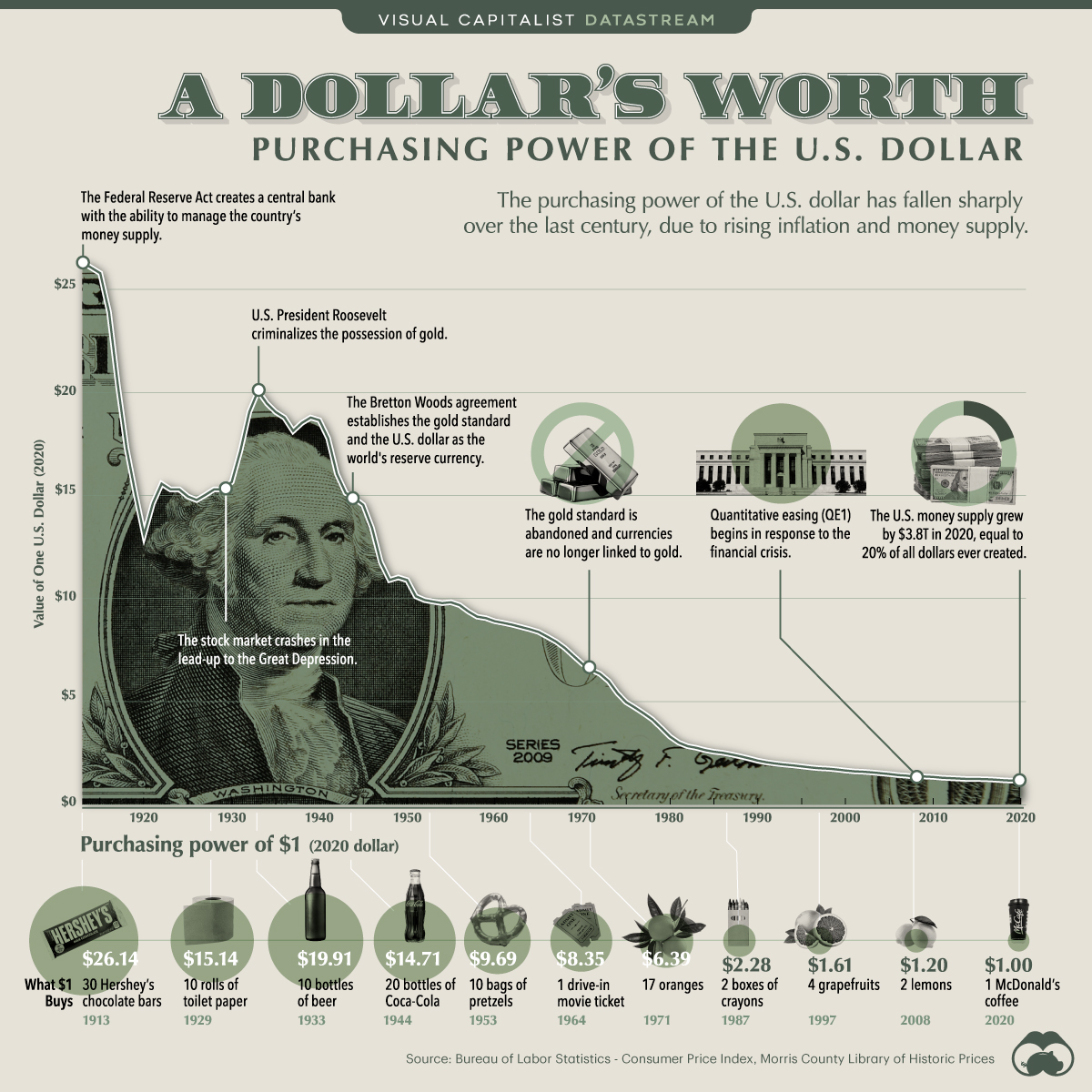

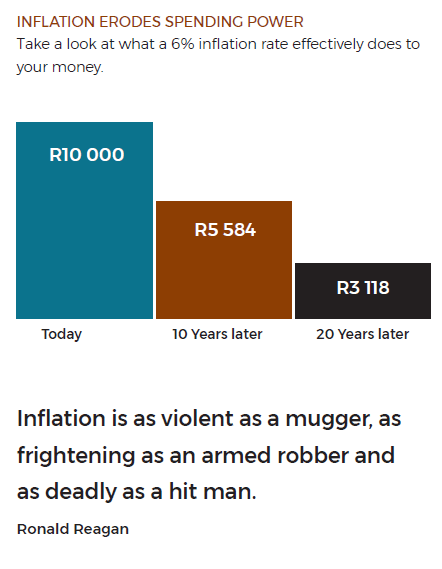

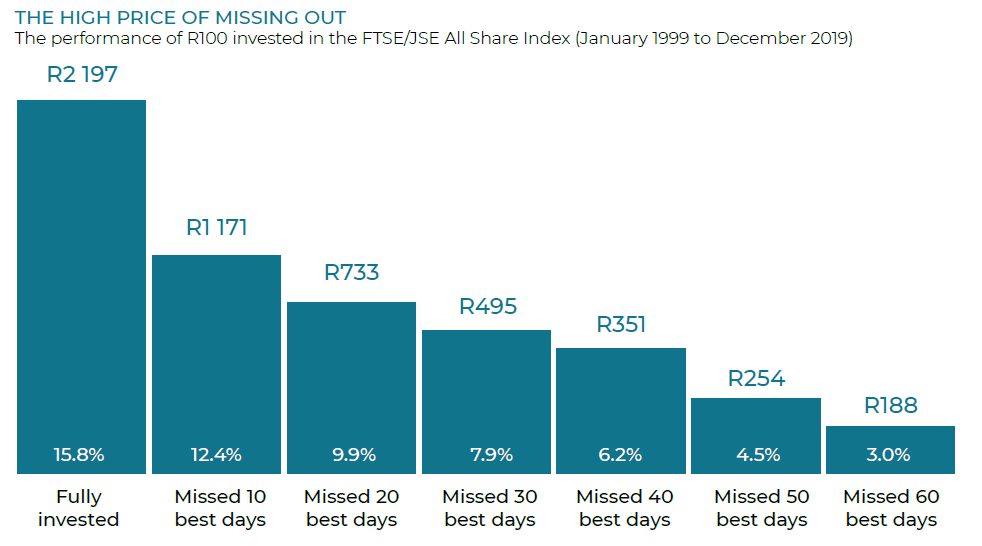

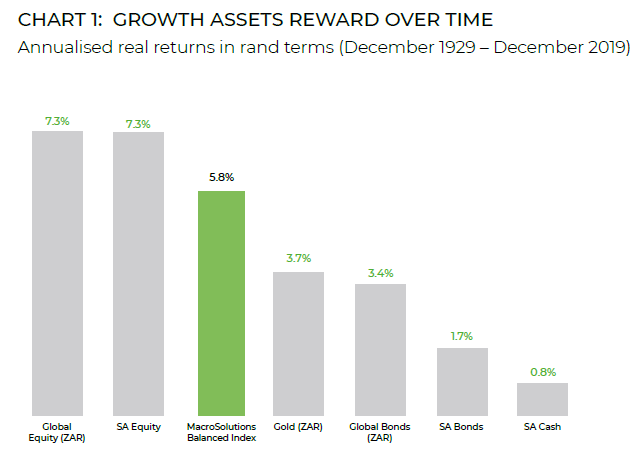

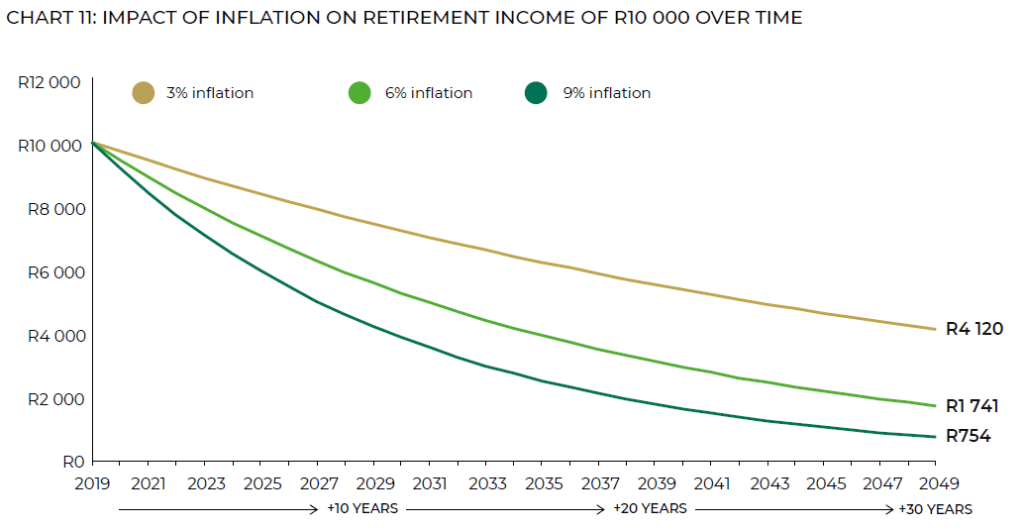

On the other side of the spectrum, sitting on the sidelines and missing those good days can be detrimental to your savings. Shying away from risk is detrimental to any long term investment goals as most riskless assets only produce a return at or below inflation. So complete risk aversion is not the ideal scenario to be in as well. Below is a demonstration of this. By missing out on the 10 best days of the JSE during a period of 20 years, you would be almost 50% behind on your potential return had you not taken the money out.

Consider the above to points of the spectrum, the sweet spot appears to be staying invested. By staying invested, you are actually still in the market, and therefore still exposed to the possibility of experiencing positive returns. IF YOU ARE NOT IN THE MARKET, YOU ARE GUARANTEED TO LOSE.

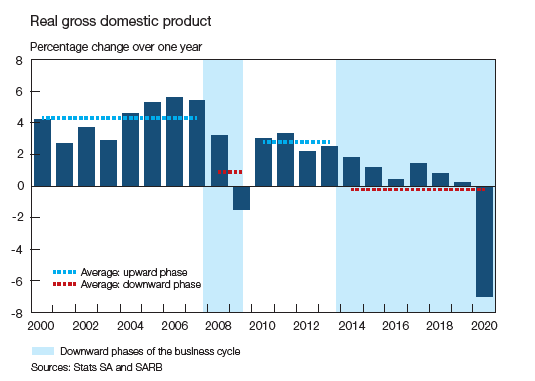

What is key is the assessment of the environment. If the environment is volatile but still supportive, you are still exposed to potentially higher returns, given that in times of volatility, excess returns can be generated as opinions on price vary quite drastically. If the environment is not supportive, then the potential for negative returns is higher. Positive environments should reinforce positive positive opinions on price, and therefore improve your potential returns, whilst visa versa for negative returns. This seems like a good framework when thinking about the current environment.

After going through this process when looking at my own investments, I am clearer on what is driving my perspective on risks and whether I should be acting or not. If I do not see any material change for the business case of a particular investment, then I am inclined to keep holding the position and potentially look to add more if I am able to get some more. Some fear volatility, others thrive in it.

Fortune only favours the brave 🙂

Until next time.

Thomo.