I read a book some time ago called “The Richest Man in Babylon” and I must admit that before buying the book, the title did get my tongue wagging. I thought that it would be a “quick guide” to all things finance and fast track my understanding of investments.

Although it fell short of what I was looking for, I did pick up more philosophy out of the book than anything else. Some of the stories in the book are worthwhile and I would encourage those of you who are interested to have a look at the book.

Key take-always I got:

- If you desire to help your friend, do not do so in a way that brings their burdens onto you. There are many ways to help people. You don’t have to choose the ways that restrict your time, money, energy, or ability to care for yourself.

- The wise lender always has a guarantee of repayment should the investment go poorly.

- Above all you should desire safety for your money. Better a little caution than a great regret.

- Youth often assumes, incorrectly, that the old and wise only have wisdom about days gone by.

- You will only begin building wealth when you start to realize that a part of all the money you earn is yours to keep. That is, pay yourself first. You always pay others for goods and services. Pay yourself as much as you can. Save money.

- Enjoy life while you are here. Do not over burden yourself with the duty to save.

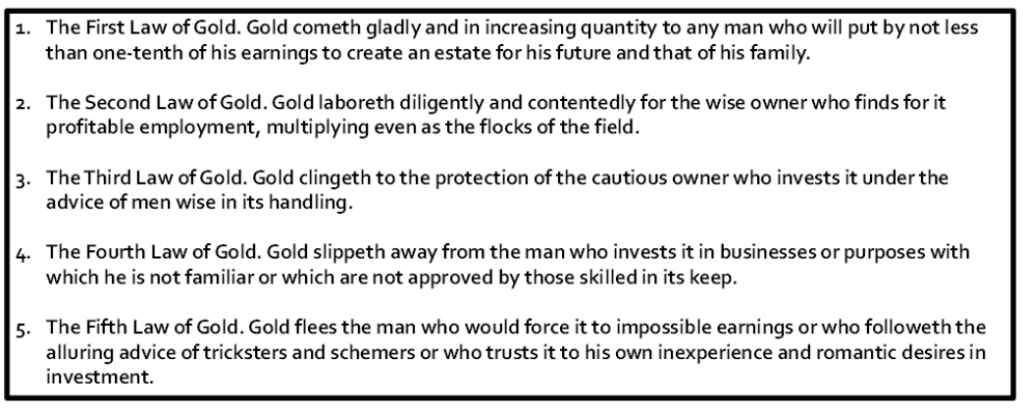

A particular section was so good that I wanted to share it for post. I’d like to think that I can leave something useful in every post. I’ll probably be using these laws in future as a reference. These laws are pretty good in terms of figuring out good habits when saving or thinking about your investments. I do believe that investors need some sort of compass that guides their investment thinking and process. We need to believe in core principles when investing, otherwise it feels pointless. I use these in my philosophy when thinking about my personal investments and finances.

The 5 Laws of Gold:

Developing conscious habits around how we view and use money is the first step in being aware of your personal finances. You need to be deliberate in the ways in which you use your money and how you choose to invest it. Consideration and careful thought should always be put into any investment decisions.

Hopefully some of these points and lessons have given you something to think about.

Until next time

Thomo

Laws of Gold. Definitely one to keep.

Than so for sharing this.

LikeLiked by 1 person

Esserntial pieces of advice to listen to 🙂 simple and straight to the pont

LikeLike

These Laws of Gold are definitely invaluable – putting an emphasis on cultivating a healthy relationship with money. Thank you for this.

LikeLiked by 1 person