Welcome back to another installment of Random Walk Theory. It has been a crazy couple of weeks out there but I am hoping that you’re all safe and healthy. We are in the last week of the first quarter and I must say, things have been moving really fast. I needed to take some time out during the weekend and take care of all the “adult” things I’ve been meaning to do for the past couple of weeks. I needed to have a day where I can just clear everything off my plate, clean out the decks and prepare for the new financial year ahead.

One of my tasks was figuring out what am I going to do from an investment perspective now that the new financial year is almost upon us. I was trying to figure out what low hanging fruit am I passing up on, “where is the free lunch?” so to speak. This is how today’s topic came about. Tax Free Savings Accounts, or TFSA’s if you’re feeling snazzy.

I had always been exposed to them whilst working but never really took much of a liking to the idea of it. I was a Fixed Income analyst at the time, and SA Equity was doing absolutely nothing for anyone. SA Bonds had been the best performing asset class over a 3 year period and cash had been a great place to park your money. I had fallen into a belief that Fixed Income would continue to dominate as South Africa’s economy slowed over the years. Nothing else mattered, it was all about yield in South Africa in my mind. Classic anchoring bias, taking what I saw at that moment in time and believed that it would continue to be like this for the next couple of years.

For those wondering what Anchoring Bias is exactly, here is a great definition,

Anchoring or is a cognitive bias where an individual depends too heavily on an initial piece of information offered to make subsequent judgments during decision making. Once the value of this anchor is set, all future negotiations, arguments, estimates, etc. are discussed in relation to the anchor

I had shunned the idea of owning anything in a TFSA or even Equities for that matter because I was receiving information at the time that simply confirmed what I was seeing, creating almost a false positive in a way. After taking some to have a think, and remembering to try guard against any biases (there always are), I came up with a pretty cool way of thinking about how to use this product to my advantage. It also became apparent that it could be one of the more efficient ways for me to take risk, and receive a “reward” for doing so.

First things first, you may be wondering, what exactly is a Tax Free Savings Account? TFSA’s, first introduced in South Africa in 2015, provide tax benefits such that all the growth and income received on the investment is exempt from tax. Yeah that’s right, no taxes! This is because you initially invest with money that has already been taxed. (money from your salary as an example). This is the condition on TFSA’s, in that your contributions towards your TFSA is made with after-tax money meaning that no tax deduction is available on your contributions as is the case of retirement fund contributions. So this should be viewed as additional saving above your retirement fund contributions. You cannot ask SARS for a tax rebate on the contributions you make to this type of fund.

That brings me to the 2nd and 3rd “constraints” with TFSA’s. You are limited to a contribution of R36 000.00 a year, and R500 000.00 over your lifetime. That means that with continuous investing every year, you will reach your contribution limit of R500 000.00 in around 14 years. So the fund will reach maximum capacity after 14 years. After that, there is no further tax benefit available, you will need to invest further using a a fully taxable account. You are further restricted in that any money that you decide to pull out will not be “credited” against your contribution limit. What I mean by this is that, if you have contributed R36 000.00 and the tax year is not over, and decide to take out R3000.00, you are not allowed to “top up” your investment by another R3000.00. You already reached your contribution limit, even if the value of your fund is lower.

Now I’m sure at this point TFSA’s are not sounding as good as I am making them out to be but this is where they win.

Over a long enough time period, the taxes on your portfolio that need to be paid over time increase as your portfolio grows in value, so as time goes by, your tax bill is growing as well. With a TFSA, the amount you initially invest is the only time the amount of money gets taxed, since it is money that has already been taxed (remember, TFSA’s are paid with after tax income). On a long enough time period, the impact of an increasing tax bill eats away at returns, all else equal. So, you have massive upside, if you have a long enough time line on investment.

Taxes also participate on the upside. If you have a killer day in the market, be assured that you will be taxed accordingly. Now here’s the great part, in a TFSA that doesn’t happen!!! When you win, you keep all the chips!!!! So in a round-about way, you’re being compensated to take risk because when you win, it’s all you!! You have the added benefit of realizing the money that should have been paid in taxes. Money on the table!! You just have to wait!!!

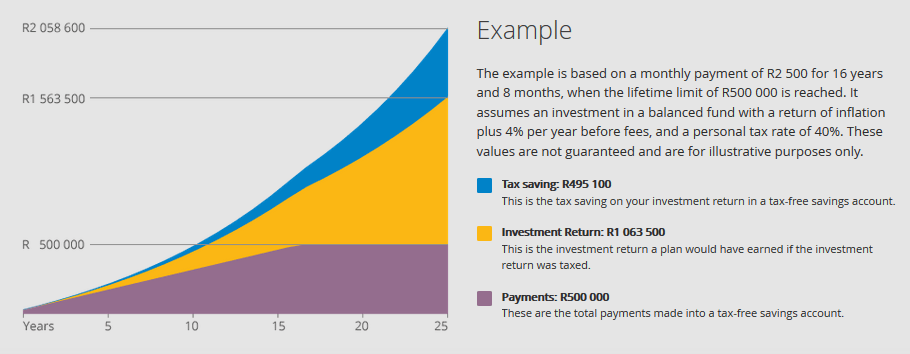

The chart below highlights this well. In purple, you have the payments, or contributions, to your TFSA over time. In this scenario, a contribution of R2500 a month will reach capacity in 16 years. The yellow shaded area highlights the growth in your portfolio if the returns were taxed at the assumed rate of 40%. The real beauty about TFSA’s is the blue shaded area. Imagine if you never got taxed at the 40% rate every year, you would have all that extra cash sitting in the market, earning returns. You’d be compounding on a bigger base. That’s the beauty of the TFSA’s. Over time, the benefit of no taxes + capturing big market days produces even great returns.

So i guess the next question would be, what was holding me back? Well I wasn’t sure of what the world will look like after that period. Imagine allocating capital for 14 years and having that capital not grow much due to something happening? That was the worry. I had anchored myself in the belief that the economy will not go anywhere and that there will be no returns anywhere. I’m pretty sure many people believe this given the current economic environment.

Now, the only way I know how to combat this feeling is with data, or some form of analysis that will provide me with some version of the truth. After all, what I am battling is bias and I believe that when you find yourself in such a space, you need to have tools that help ground you and give you a center that helps you find the truth. It also suits my personality in a way, given that I feel comfortable with data and numbers.

Now, this is where the cool charts come in. A document produced by MacroSolutions, called Long Term Perspectives, features some really good information on asset classes and provides some interesting charts that have lingered in my mind since I first saw them. These charts look at long term data and give some insight as to how asset classes perform over time.

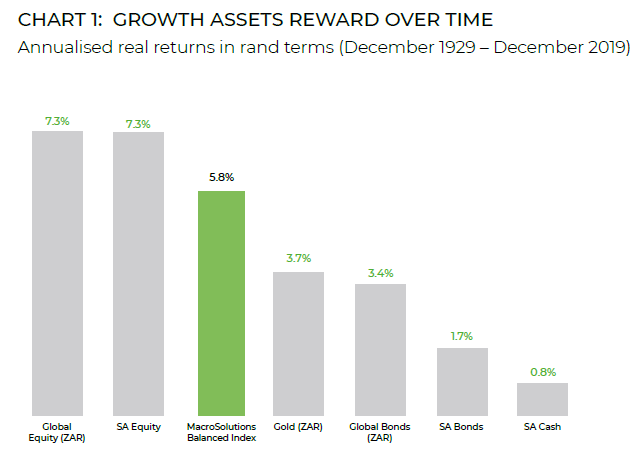

First chart is a reminder that over time, risk assets do indeed reward you. What is shown is the annualized real return of different asset classes over time. Global Equity and SA Equity have been the best performers over the 90 year period whilst Bonds, Cash and Gold returned much less. In green, we have the MacroSolutions Balanced Index, which is a fixed benchmark we use when looking at long term performance of a Balanced fund vs single asset classes. The green bar shows that a combination of different assets can lead to a better outcome over a longer period of time vs just holding Bonds or Cash or even Gold. It justifies the argument that over the long term, a portfolio with growth assets will outperform safe assets.

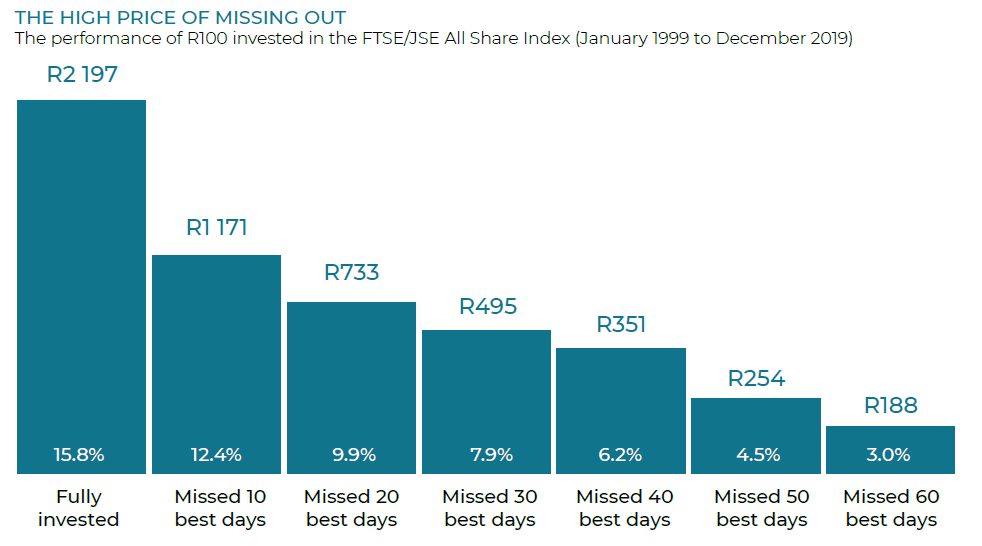

Second chart was also very interesting and perhaps the most interesting chart. It was a bit of analysis done where we looked at what your returns looked like if you had missed a particular number of “best days” in the market. The truth is, no one can predict the future repeatedly, people do get spooked when something crazy happens in the market, but what appears to be apparent to me is that panic is always against you. It’s all about the time spent in the market, versus timing the market which is a difficult task to get right over and over again. The chart shows that if you missed the 10 best days from January 1999 to December 2019 (just over 7300 days; so missing just 0.13% of all days in that 20 year period), your returns would have been almost 3% lower than what they would have if you had just left your money alone. And again, no one knows when these 10 days will happen with 100% accuracy, so trying to do so is very difficult and you’re much better off staying invested. Your risk of missing a big day is zero if you never take the money out because of fear!!!

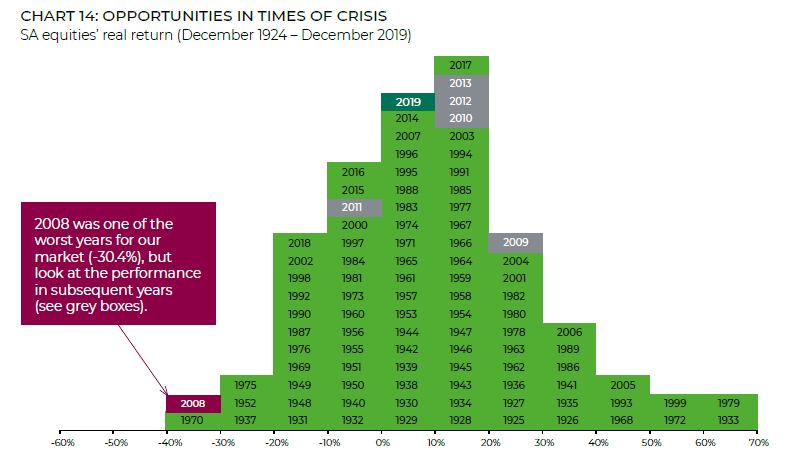

The third chart is a reminder, that even when equities do have a bad year, the returns from the market tend to be positive over time, with some years being the real outliers. We confuse really bad years with the idea that what currently happens will carry on in perpetuity. I do admit that I am an optimist at heart, but when data stacks up like the chart below, it leads me to believe that my optimism is justified and that returns, over a long enough time horizon, do pay you for patience. What we need to guard ourselves against is the knee jerk reaction we get when we see some bad performance and believe that things are doomed to carry on as it is in the current moment.

This leaves me with the following conclusions:

- TFSA’s allow me to capture extra return, if I just wait long enough. I just need to let the tax advantage accumulate over time. All the years of no taxation on my growth assets allows me to always have a pile of money that compounds without any seeing any drop in value coming from taxes, everything else remaining the same.

- Time is my friend when it comes to TFSA’s. Not only for compounded returns, but also just riding out market volatility.

- It’s about time in the market, trying to time the market is very difficult and leads you open to missing the really big days.

- Taking advantage of the tax year roll over, meaning I begin investing as soon as the tax year begins and a fresh yearly limit of R36 000.00 allocation to the TFSA is allowed, allows me to capture more Time in The Market. This is exactly what I want given that I don’t know when the Best Days will arrive. So best be waiting in the waters when it does.

- If I have a long time horizon + no taxes on returns + take on more risk = GREATER AFTER TAX RETURNS !!!!!

- So the only thing I have to solve for is WHERE DO I TAKE THIS RISK that I intend on riding out for a long time, because the data shows that risk wins in the long term, and the stock market rewards those who stay invested because no one can time the market consistently forever.

The last point was the best insight for me, I solved the initial problem of allocation. Given what I have found, and the lessons I have learned, the conclusion seems to be, I should add the most risk in a TFSA because you get rewarded over time (in compounded, tax free returns). The data also shows that over time, risk assets outperform and patience is rewarded. This also solves for my bias, in that it protects me from making a poor asset allocation decision.

Now to go out there and hunt for opportunities 🙂

Until next time.

Thomo

Great points all round!

LikeLike

Very interesting. I also started my TFSA in the last week of Feb, but yiu’ve just raised an interesting point. I am a Provisional tax payer. I only get taxed in Aug 2021. Should I only start contributing to this Fin year after those taxes are paid?

LikeLike

Hi Liesel, I am afraid I do not know the inner workings with regards to tax laws. You’ll have to consult a tax practitioner for that. Great question I must say 🙂

LikeLike